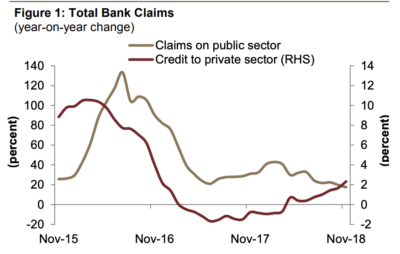

A recently-released report by Jadwa Investment finds a gradual pickup in private sector lending since April 2018 after showing a slowdown in 2017 and Q1 2018.

The Monetary and Financial Update report from the Riyadh-based Jadwa looks at the Kingdom’s monetary policy and other key economic data.

Since April 2018, the annual growth in credit to the private sector has moved back into the positive territory.

Jadwa Investment sees “a rising level of uncertainty” in the Fed’s rate decisions in 2019, with a downside projection, as the Fed’s latest statement acknowledged the slowing in global growth. “Accordingly, we expect to see the Saudi Arabian Monetary Authority (SAMA) following the Fed’s decision, with a maximum of two rises during 2019, down from an expectation of three. If the Fed decides to go with its plan of two hikes in 2019, we could see the repo rate at 3.5 percent, and the reverse repo at 3 percent, by the end of 2019.”

Looking forward, Jadwa says it sees a “number of elements weighing on private sector credit activity, such as VAT and the continuous reforms in the labor market. However, we believe that the record government spending stated in the 2019 fiscal budget of SR1.1 trillion will positively impact credit to the private sector and bank deposits as well.”

[Click here to read the full report from Jadwa Investment] [Arabic]