Saudi Arabia’s largest share offering in four years for Arabian Centres shopping malls has been postponed for two days amid rising geopolitical tensions and a looming trade war between the U.S. and China, but when trading begins, it will still be a historic moment for Saudi Arabia’s markets.

In addition to being the biggest IPO in four years, the listing will also be the first time that shares can be directly sold to qualified institutional investors in the U.S. under a new securities rule introduced in 2017, MarketWatch reports. As such, it is considered the first “truly international IPO” for a Saudi company.

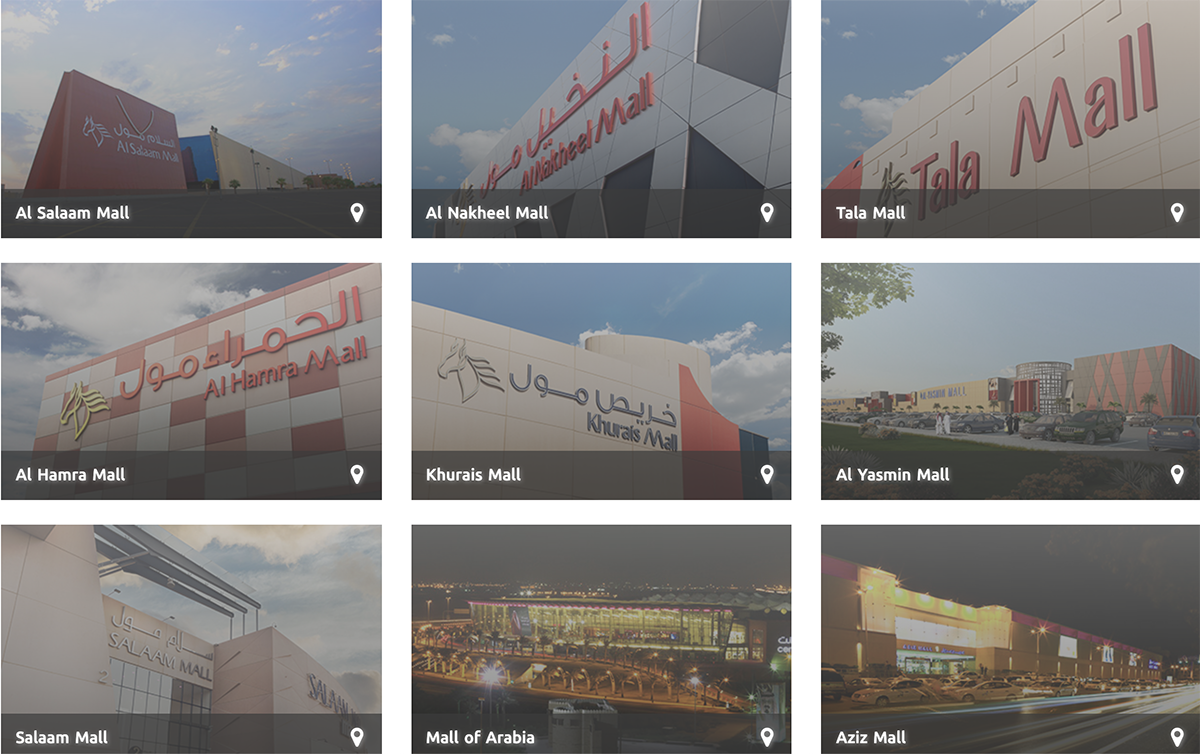

Arabian Centres is the largest owner and operator of shopping centers in Saudi Arabia, which include 19 “lifestyle centers” in 10 cities, which have more than 4,000 retail stores and host more than 109 million visitors, the company says on its website.

Arabian Centres plans to expand its operations to 27 malls within four years, including four in the next 12 months, CEO Olivier Nougarou said this month, according to Reuters.

Shares are set to start trading on Wednesday. Arabian Centres expects to raise 2.6 billion riyals ($690 million), having been priced on May 8 at the bottom of the range of 26 to 33 riyals per share, according to MarketWatch.

Riyadh-based Arabian Centres is owned by the Fawaz Alhokair Group.