Jadwa Investment’s latest Quarterly Oil Market Update anticipates that OPEC’s decision to announce, but not to implement, a cut in production will likely lead to a small cut in oil production “more akin to a production ’freeze’ rather than an outright cut”.

“Any agreement by OPEC, if reached, will of course need to be acted upon with discipline by all members for it to be effective, and this is where the real risk lies,” the Riyadh-based Jadwa Investment said. “Any large increases in output between now and November and/or after an agreement is finalized, would see the market losing faith in OPEC’s ability to curb output, which would ultimately result in oil prices declining.”

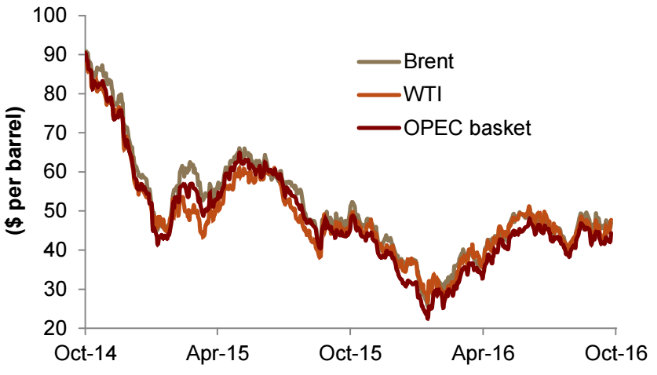

Oil Prices have risen since the OPEC announcement.

OPEC plans on meeting in November, when the extent of OPEC cuts and individual country quotas are to be decided.

“At these price levels, OPEC members facing more acute financial pressure would be provided some relief, but, at the same time, prices would not be high enough to encourage too strong a supply response from US shale oil, Jadwa said. “Any agreement by OPEC, if reached, will of course need to be acted upon with discipline by all members for it to be effective, and this is where the real risk lies. Any large increases in output between now and November and/or after an agreement is finalized, would see the market losing faith in OPEC’s ability to curb output, which would ultimately result in oil prices declining.”

[Click here to view/download the full Jadwa Investment report as a .PDF file]