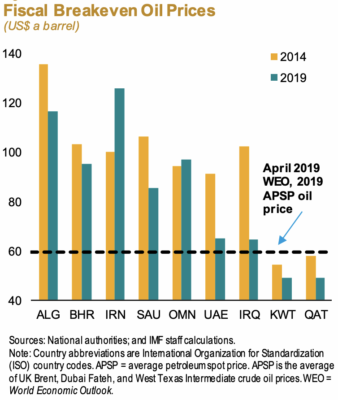

A recently-released IMF report on the oil-producing Middle East and North African economies said that Saudi Arabia’s newest breakeven price for oil – the price of oil at which its government could fund its operations without a deficit – is $85 on the Brent index.

The report is a quarterly update on the economies of oil-producing states in the region. The report finds growth in Gulf Cooperation Council (GCC) countries is “expected to improve slightly to 2.1 percent in 2019, up from 2 percent in 2018,” as “government spending and multiyear infrastructure plans will likely provide some support to economic activity in Kuwait and Saudi Arabia.”

Fiscal breakeven oil prices shows that Saudi Arabia needs $85 oil to fiscal balance, the IMF said.

“Policymakers will face the challenging task of resuming fiscal consolidation while sustaining growth in a more uncertain external environment, including bouts of oil price volatility that are likely to persist in the near term,” the IMF notes. “Anchoring fiscal policy in a medium-term framework would help insulate economies from oil price volatility and gradually rebuild fiscal space; addressing structural weaknesses and tackling corruption, including better access to finance for small and medium enterprises (SMEs), will help diversify economies, create jobs, and promote higher and more inclusive growth.”

But some oil economists dispute the notion that Saudi Arabia’s breakeven price stands at $85. Ellen R. Wald, author of a recent book called Saudi, Inc. which profiles Saudi Aramco and the Saudi Arabian oil market, says the IMF is “wrong” about needing $85 oil.

“The problem with this claim is that it inaccurately implies that Saudi Arabia must work to achieve higher oil prices. However, this isn’t true and Saudi Arabia does not base its oil policy on the budgetary break-even price per barrel of oil,” Wald writes in Forbes, while adding, “Aramco oil revenue and Saudi revenue from Saudi Aramco are not interchangeable.”

The report also found that fiscal expansion is “likely” in Saudi Arabia this year, as is a decline in inflation in the Kingdom.

[Click here to read the full report as a downloadable .PDF file]