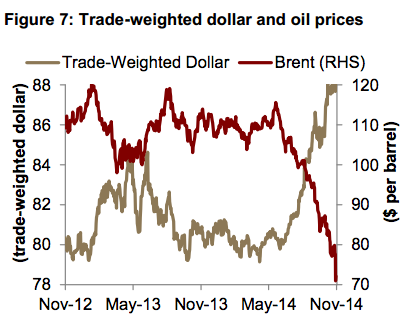

After a significant drop in oil’s price on international markets since July 2014, the impact on the Kingdom of Saudi Arabia’s budget and fiscal policy is assessed in Jadwa Investment just-released research note.

Head of Research Dr. Fahad Alturki notes that the recent decision not to cut output by OPEC “adds further uncertainty not only on the global oil market and the outlook for oil prices, but also on the outlook for the Kingdom’s fiscal policy…These lower prices will have a direct impact on the balance of payments and fiscal position of the Kingdom. While we expect the government to maintain the current elevated level of fiscal expenditures, negative sentiment associated with fiscal deficits could lead to slower non-oil economic activity.”

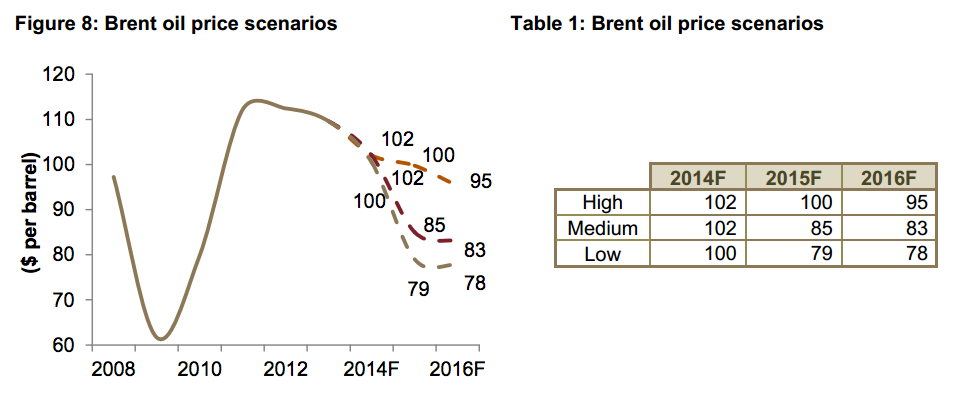

Alturki notes that “while such decisions along with other variables in the market would result in different price levels over the next two years, prices of $85 and $83 per barrel for 2015 and 2016, respectively, are most likely.”

“OPEC’s strategy of trying to limit growth on non-OPEC does of course present risks, most notably that no action on limiting production could lead to even further price declines and that these price declines do not slowdown supply growth from US shale oil.”

The full report can be found here and contains a number of excellent charts and graphics that provide context on the fall of oil’s price and forecasts the impact on the Kingdom’s budget.