A recently released Jadwa Investment report researches the impact that Vision 2030 is likely to have on international trade and investment flows with Saudi Arabia.

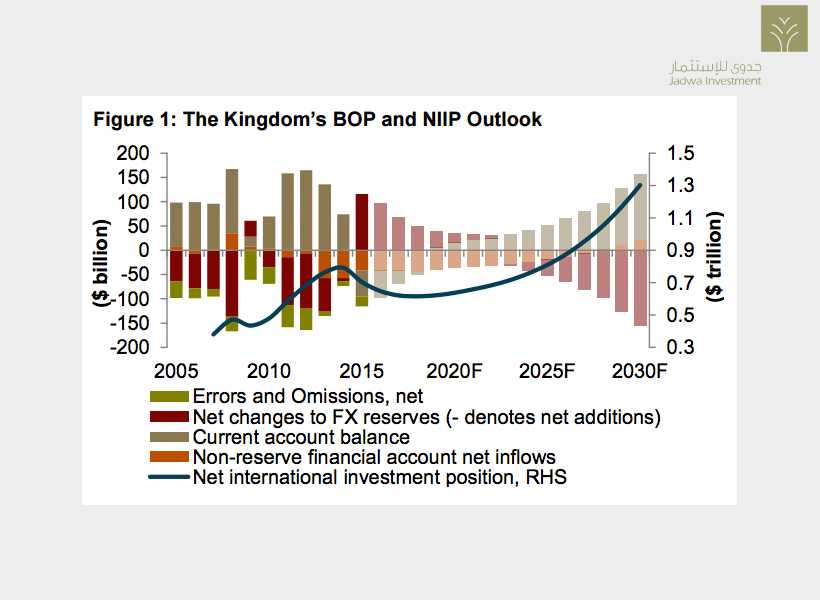

This report looks at the evolution of the current account for the period 2016-30, which is forecast to reach a surplus of $135 billion (8 percent of GDP) by 2030.

“While oil export receipts are expected to recover over the next fifteen years, their share of total current account inflows is forecast to decline. Meanwhile, structural reform will lead to non-oil current account inflows rising from $85 billion in 2015 to $262 billion by 2030.”

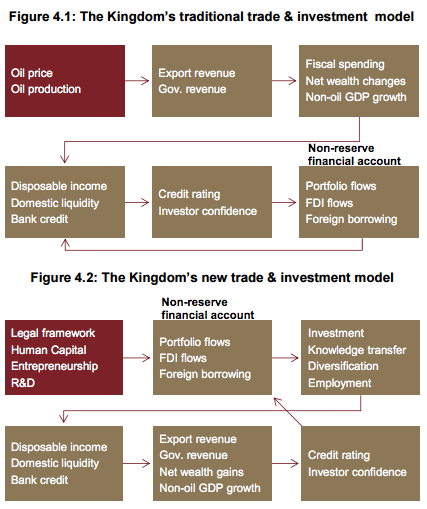

Traditional and new trade and investment models for Saudi Arabia, via Jadwa Investment.

The Riyadh-based investment group also forecasts non-reserve financial inflows to play an important role over the next fifteen years, as they become driven by reforms in key areas of doing business in the Kingdom.

More observations from the report, available to download at the link below:

- The anticipated improvement in these inflows will have significant implications on the domestic financial system, as linkages to international financial institutions grow.

- The rising role of non-reserve financial flows will also mean that the fixed exchange rate will remain intact and will act as an anchor for stability, supporting a period of rising investment and financing activity.

- Implementing the reforms envisaged by Vision 2030, will contribute to supporting the Kingdom’s net international investment position (NIIP), which we forecast to reach $1.3 trillion (77.6 percent of GDP) by 2030.