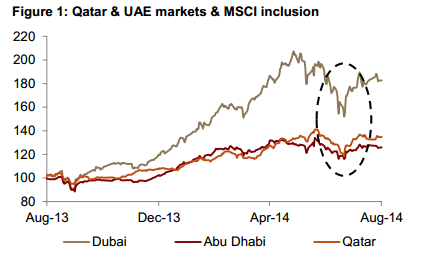

Jadwa Investments is a well respected Shariah-compliant investment bank based in Saudi Arabia. Jadwa’s market studies and regular updates can be counted on to be highly informed and concise analyses of the topic at hand. Their monthly ‘Chartbooks,’ quarterly GDP updates, annual budget report and specific sector analysis are regular features on the Saudi-US Trade Group website as well as that of our partner SUSRIS.com. So, we were delighted to see Jadwa’s just-released commentary entitled Opening the Tadawul up to Foreign Investors. It is worth the read and provides a road map for not only what can be expected in the run-up to the anticipated opening of the Tadawul to foreign investors in H1 2014 but also what might ensue as that transition evolves. Based on the experience with the UAE and Qatari bourses, we should anticipate a run-up in prices as the opening in H1 2014 nears. Over 4 million retail investors interact directly with the Saudi Tadawul owning more than a third of shares and accounting for over 90% of daily trading volume. These individual investors have shorter-term investment horizons and typically have a higher level of risk tolerance.

Currently, retail investors in Saudi Arabia account for a higher proportion of traded volumes when compared to other large emerging market indices. In China, retail investors account for 60 percent of stock market volume, down from around 90 percent in 2003, prior to opening the market, whilst Indian retail trade volumes account for around 34 percent, with retail investor volumes much smaller in the US, where they account for less than 2 percent

Despite this anticipated run-up in prices, Jadwa sees the Saudi Tadawul’s fundamentals as very strong:

It is important to highlight, however, that the surge in optimism fuelling the current TASI rise is not based wholly on speculative gain or positive sentiment, it is also a due to a flourishing Saudi economy, which is underpinned by strong economic fundamentals.

We see governmental spending plus stable international oil prices maintaining elevated levels of business and investor confidence, going forward. Sectors with strong linkages to the domestic economy, such as construction, transportation, retail and manufacturing, will continue to perform well, but so will the two largest sectors, banking and petrochemicals. The banking sector is riding high from soaring consumer lending and a widely anticipated rise in US interest rates will add to future profitability. The petrochemicals sector continues to benefit from low feedstock prices, which means it is well placed to benefit from an upturn in demand as the global economy picks up.

Passport Capital Founder and Chief Investing Officer John Burbank echoed this sentiment recently on Bloomberg’s Market Makers show.

We were invested before the market opened. There is about $40 billion of passive index money that will come in by 2017. The reasons to not pay attention to Saudi are vanishing.They are a big market. The economy is growing almost 5%. Earnings growth is going to average 20% next couple of years, dividends over the next 12 months is 3.5%. I would much rather own a 3.5% growing dividend than Spain.

Following the initial opening, Jadwa foresees numerous positive effects of increased foreign investment in the economy. Predicting greater transparency across all markets and more competitive Saudi companies.

In the longer term, as foreign investors take up stakes in Saudi companies, and hold management accountable for strategic decisions, this will, in turn, promote improvements in efficiency, including an improvement in the use of assets in generating sales and ultimately increasing RoE. Therefore, when the Saudi government does eventually decrease the level of support to some sectors, such companies will be better placed to maintain profits, as the higher level of RoE will attract more investors.

The process of opening up the stock market should also be accompanied by increased transparency from administrative bodies, through the availability of consistent macro-level economic information. Countries that have some of the most sophisticated and advanced stock markets also have a body of pre-defined periodic statistical publications made available by public bodies. In specific, the availability of timely and consistent macro-level data, such as economic and demographic statistics, contribute to private information gathering and dissemination, all of which, in turn, contributes to developing well-functioning stock markets.

Ultimately, Jadwa sees Saudi Arabia’s Capital Market Authority (CMA) taking its cue from the China Securities Regulatory Commission’s opening of the Shanghai Stock Exchange in 2003. That mechanism has proved to be successful and Jadwa is optimistic that CMA’s similar approach in Saudi Arabia is well advised.