A recently released report by Jadwa Investment finds that, following the US Federal Reserve’s second rate hike since 2008, the US’s path to policy normalization “is expected to accelerate.”

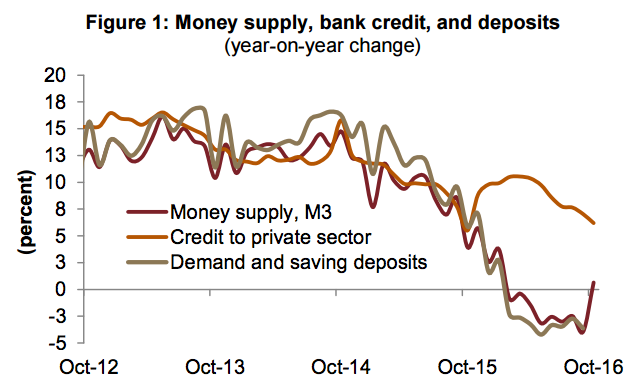

Money supply, bank credit, and deposits.

For the Saudi monetary system, the Saudi Arabian Monetary Authority (SAMA) has passed several measures to enhance liquidity in the domestic financial system, which has contributed to lowering the cost of funding, Jadwa said, adding that growth in money supply has rebounded in recent months, benefiting from higher deposits as a result of a resumption of government payments to the private sector.

More findings from the report:

-Claims on the Public Sector: Following the international sovereign bond program, in October 2016, domestic banks have seen a modest rise in their claims over the public sector.

-Credit to Private Sector: Sentiment will play an increasingly significant role in determining growth in private sector credit during 2017, particularly following tightening liquidity that persisted before October.

-Sectoral Credit: Within the private sector in Q3 2016, net credit was higher, year-on-year towards commerce and agriculture.

-Financial Soundness: The financial system is still liquid and can provide room to finance both the public and private sectors, but with sentiment playing a key role.

-Capital Outflows: The surge in net capital outflows that pushed down FX reserves at the beginning of 2016 moderated in Q2 and Q3 2016, mainly due to an improvement in both the current account and the non-reserve financial account.

[Click here to read the full report from Jadwa Investment]