Nasdaq Dubai will launch futures trading in Saudi quoted companies “before the end of this year,” according to reports, marking the first time Saudi stocks can be traded in derivative form.

The move will allow global investors to trade shares in Saudi Arabian listed companies via contracts to buy or sell shares at a set price in the future, and is “expected to add to the attraction of the Kingdom’s financial markets among international investors,” according to Arab News.

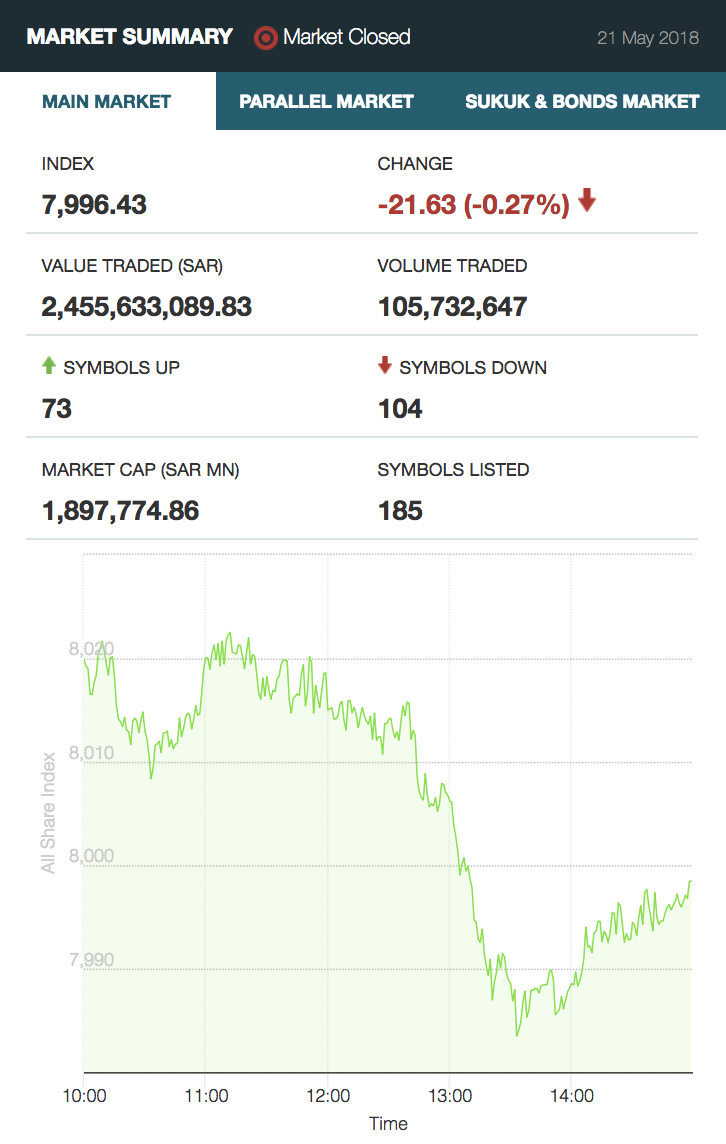

Saudi Stock Exchange May 21, 2018.

The Tadawul stock market index has risen about 11 percent this year ahead of a potential upgrade to emerging markets status by index firm MSCI in June, and the planned share sale of oil giant Saudi Aramco.

“The futures will give investors new hedging tools to take long and short positions on the companies, at a time when international investor interest in the Saudi stock market is increasing rapidly,” the bourse said in a statement.

“We are delighted to provide investors with an exciting new route to gain exposure to the Kingdom’s dynamic and rapidly expanding equity markets. What we’ve seen happen in Saudi Arabia is impressive reform, progression and change, and there is a lot of regional and international interest in the stock markets there,” Hamed Ali, chief executive of the Dubai-based exchange said. “This is good news for our two markets, and a good step in building a stronger bridge between them,” he added.

According to Arab News, the Kingdom’s stock exchange, the Tadawul, has announced its intention to enable futures and other derivatives trading, but its plans are still thought to be some way from implementation. Earlier this month it announced the setting up of an independent clearing house, essential to pave the way for derivatives trades.