In the wake of last week’s OPEC decision to reduce crude oil production, oil prices have surged roughly 15% in just one week. At roughly $55/barrel on Brent, that’s the highest level in more than a year.

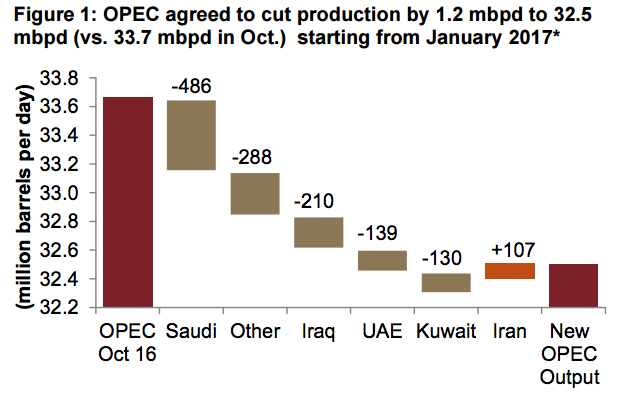

OPEC agreed to slash its output by 1.2 million barrels a day, or more than 1% of global output, and said that other producers will also join the effort. “If implemented, the cuts would shrink the oversupply that has plagued the industry for more than two years and further boost prices next year, with some analysts seeing crude rising above $60 a barrel,” the WSJ writes today. “The success of OPEC’s deal, however, will depend on several factors, including the participation of nonmember countries, the cartel’s own checkered history of cheating such agreements, and the ability of U.S. shale drillers to quickly ramp up production as prices rise. On Tuesday morning, Brent crude, the global oil benchmark, was down 0.3% to $54.80 a barrel.”

Saudi Arabia contributed the most to cuts, at 42 percent of the

total cut, Jadwa said.

A recently released report by Riyadh-based Jadwa Investment provides insights and key observations as the world’s suppliers attempt to reign in oversupply in 2017.

“If we disregard the risks to the current deal, and assume that there are disciplined cuts at agreed levels, then we would expect to see more aggressive oil market rebalancing than previously. Furthermore, a continuation of the OPEC agreement beyond the initial six month period could result in tighter oil markets in 2017 as a whole, with oil balances in deficit by 730 thousand barrels per day (tbpd) compared to a surplus of 1 mbpd with no OPEC action,” Jadwa said. “Such a turnaround in oil market balances would have a positive effect on Brent oil prices. We estimate that the minimum impact would be a rise in Brent oil prices to $60 per barrel (pb) for 2017, compared to our current forecast of $55 pb.”

“At $60 pb, but lower crude oil production for the Kingdom at 10 mbpd, as per OPEC’s agreement, we would expect a marginal improvement in our forecasted external balance for the Kingdom. Saudi export revenues would rise by $10 billion vs. our current forecast, the current account deficit would improve to 2.2 percent of GDP (vs. 3.1 percent of GDP) and the budget deficit would shrink to 4.8 percent of GDP (vs. 5.8 percent of GDP). Overall, whilst the OPEC cuts represent an up-side risk to oil prices, due to the hurdles mentioned above, we are not revising our current forecasts just yet, but will be monitoring developments closely,” Jadwa said.

[Click here to read the full report from Jadwa Investment] [Arabic]