The Petrochemicals sector in Saudi Arabia makes up 60% of the Kingdom’s non-oil exports and remains vital to the Kingdom’s Vision 2030 aims, according to a recent study on the sector released by Jadwa Investment.

The sector’s prominence in the non-oil economy means it has been identified by both the National Transformation Program (NTP) 2020 and Vision 2030 to help lead the push away from fossil fuel reliance, Jadwa writes. “This will be achieved by moving the sector towards increased downstream specialty and end product capacity, thus helping to establish a higher value adding manufacturing base and, at the same time, creating employment opportunities for Saudi nationals.”

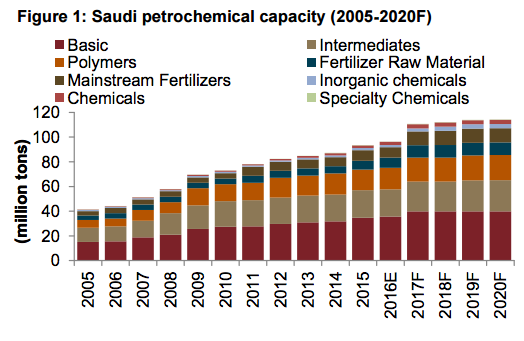

Petrochemical capacity in Saudi Arabia.

“But the restructuring of the sector comes at a time when it is already facing up to a number of challenges, both at home and abroad. Besides seeing a drop in global chemical prices in the last two years, the sector has also seen domestic feedstock prices being raised in 2016, with further rises expected in 2020. In addition, global competition is set to intensify, especially from the US and China, where significant rises in petrochemical capacity are expected in the next few years,” according to Jadwa. “All these factors combined will re-shape the petrochemical industry in the Kingdom, but overall, we do not expect the sector’s importance in the Saudi economy to diminish.”

Saudi Arabia’s share in the petrochemicals world supply is currently 6%.

The Kingdom had the region’s largest oil, gas and petrochemicals market between 2011-2016, with a total of $69.37 billion worth of contracts awarded – a quarter of the regional total. The bulk of these awards were in 2011 and 2012 with over $47 billion spent, according to a report. Average spending has dropped considerably in the subsequent four years.

Saudi Arabia’s project pipeline is buoyed by the region’s two largest projects, both in an early stage: Sabic’s oil-to-chemicals project and Aramco’s integrated refinery and petrochemicals development, both at Yanbu on the Red Sea coast. “These projects aside, Aramco is likely to prioritize projects to expand its gas capacity which includes higher gas processing capacity, the development of non-associated gas fields in the Gulf and expanding shale gas production in the north,” the TradeArabia news service reports. Aramco plans to spend $334 billion across the oil and gas value chain by 2025.

The Jadwa Investment report provides an outlook on global demand, supply, and discusses the likely impact of the recent energy price reform in Saudi Arabia on the petrochemical sector.

[Click here to read the full report from Jadwa Investment] [In Arabic]