If Saudi Arabia as the de-facto head of OPEC used to set the ceiling for the price of oil, now it looks like that role has been taken over – by U.S. shale producers. However, Saudi Arabia can still set the floor.

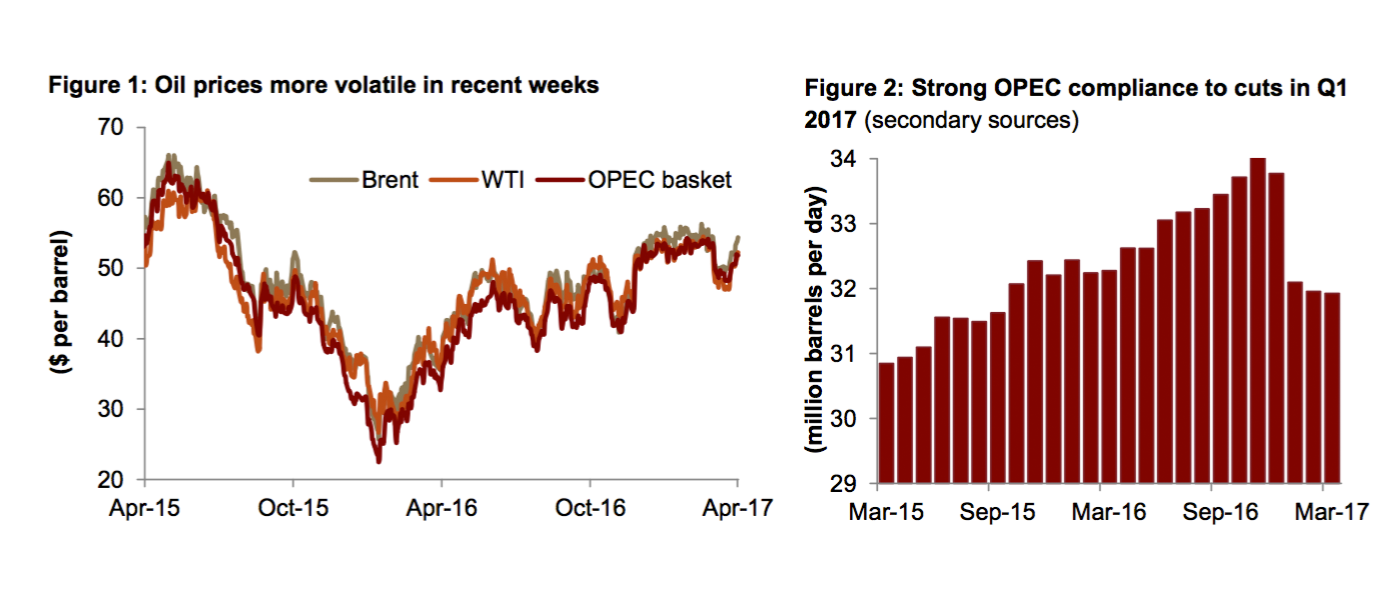

According to recently released data by Riyadh-based Jadwa Investment, Both OPEC and non-OPEC cuts are contributing to a reduction in global oil balances. Latest OPEC data shows that crude oil production from OPEC members averaged 32 million barrels per day (mbpd) in Q1 2017, down 1.6 mbpd from October 2016 levels. Meanwhile, Russia, who also committed to cuts, has reduced oil production too, Jadwa notes.

But oil is still down roughly 8% this year. And one market analyst, who predicted the collapse of oil several years ago, said that it is unlikely to reach $60 again soon and if it does, it will be brief.

“It’s the sense that too much gasoline and really a drop in U.S. demand in particular, but a little bit of softness in India and some other places, is going to lead to an undertow for refinery runs,” Tom Kloza, who co-founded the Oil Price Information Service and is the firm’s global head of energy analysis, said Friday as reported in CNBC.

Jadwa Investment said the risk of a faster rebound in US oil production and the lack of sustained decline in record commercial oil stocks saw prices drop by as much as 5 percent in one day in early March. Prices have rebounded since then, partially as a result of a risk premium attached to regional geopolitical developments but also due to talks of an extension to cuts in OPEC production.”

As it stands, there are risks attached to both of the possible outcomes related to the issue of extending OPEC cuts, Jadwa said. If no extension in cuts is agreed then the risk is that, with no caps on production, OPEC could recommence competition for market share, as was the case prior to the agreement, and push its production much higher than current levels.

On the other hand, Jadwa said, if the cuts are agreed and successfully implemented, oil markets would tighten further which would put upside pressure on prices, thereby encouraging an even steeper rebound in US oil output.

[Click here to read the full report from Jadwa Investment] [In Arabic]