The impact of the rise of shale production, particularly in the United States, has radically changed the trajectory of the global energy landscape. Only in the last year, when Saudi Arabia and OPEC decided to boost production rates to mute the impact of shale and regain market share, has conventional energy regained top-dog status in the global market.

But what if Saudi Arabia had its own shale boom?

Writing in the Globe and Mail, Steve Yetiv and Alexander Fretz note that Saudi Arabia, too, could have its substantial shale production capacity, despite the fact that Saudi Arabia currently has enormous conventional reserves.

“We rarely think of the Saudis as in need of new energy technologies, or as pursuing unconventional shale energy…But the House of Saud has launched its own fracking boom, and it could well be the next big thing in global energy.”

As Yetiv and Fretz write, Saudi Arabia has indeed been increasing its investment in shale technologies and exploration with what it sees as promising early results, and Saudi Aramco has raised the amount earmarked for its own boom from an original $3 billion to $10 billion.

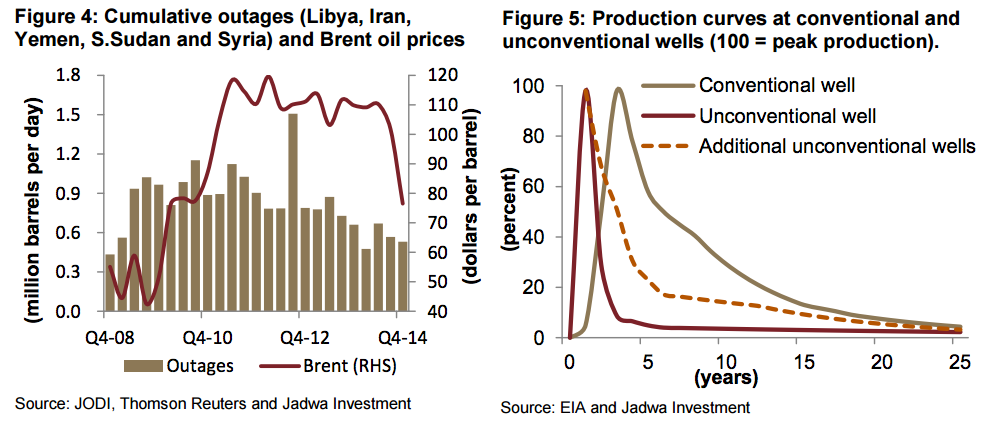

The game-changing potential of a shale boom in Saudi Arabia is just one new and major variable in a global energy landscape that is clearly in a state of transition. Saudi Arabia’s pricing strategy implemented over the last year is to regain market share from higher-cost producers by pumping crude at record levels. The result has been a significant decline in prices that have hovered around the $40-$50 range since the strategy was implemented and the price declined from over $100 a barrel in July 2014.

The Kingdom is showing no signs of taking its foot off the gas on that policy. On Monday, Saudi Arabia announced that it would continue to pump at record levels.

“The only thing to do now is to let the market do its job,” said Saudi Aramco CEO Khalid al-Falih to the Financial Times. “There have been no conversations here that say we should cut production now that we’ve seen the pain.”

The recently released 2015 EIA annual report found that while the dip in prices has been good for consumers, it may strengthen the position of Saudi Arabia and other established producers in the market, and increase new producers’ reliance on those countries for energy needs. In the United States, that translates to low gas prices for consumers and the resurrection of an old political hot button issue entering a presidential election year.

Speculators and financial houses will have their hands full accurately predicting what is next for oil and gas in the coming year. Chaos in Iraq and Syria threatens to draw the entire region into war as well as derailing Iraq’s energy producing potential. A new agreement with Iran will open that country’s oil and gas production to greater access with the reduction of sanctions. China continues to rise as a global consumer but has experienced a year of economic growing pains. In the coming decades India may surpass China in terms of energy imports required. Russia’s assertive policies in the Middle East region, as well as with its own energy sources, is a persistent unknown.