Key players in Saudi Arabia’s stock market have embarked on a “global roadshow” abroad to show off the attractiveness of the investment climate in Saudi Arabia, according to reports, with officials meeting potential investors in New York, London, and Singapore.

Saudi Arabia’s Tadawul opened to wider foreign investment in July 2015, but it did so cautiously – only approved funds with over $5b under management may invest in the Saudi stock market right now. So far, there are only 11 foreign funds that have taken the CMA up on its first offer. Other rules restrict investment from there – foreign firms may own up to only 49% of Saudi companies and no more than 10% of the total stock market can be owned by foreign holders.

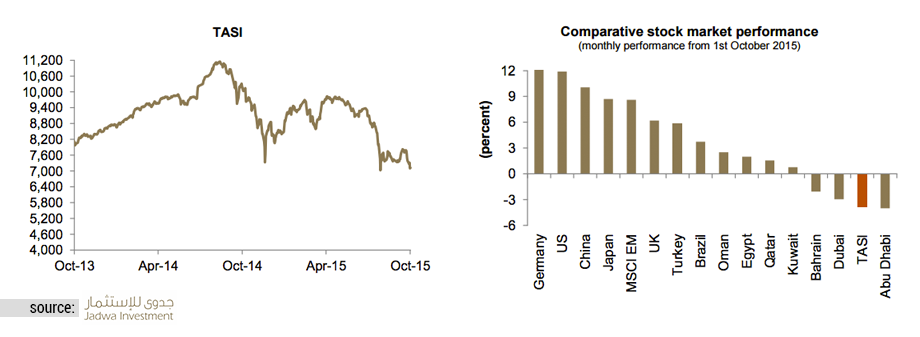

The Tadawul has had a tumultuous year, with a run leading up to the opening and a cooling off after it. The TASI has dipped more 25% in 2015. A low price of oil is also having an affect on the Kingdom’s fiscal policy, as energy makes up about 45% of the Saudi economy as a whole.

The market is managed by the Capital Markets Authority, and its CEO, Adel Al-Ghamdi, is seeking to get the market listed in the emerging markets index. This would be a first step to even wider access, possibly to non-institutional investors. Al-Ghamdi is leading the CMA’s roadshow to New York, London, and Singapore.

“International investors and the media have been particularly keen to understand the strategic context of the qualified investor program, future plans for the Saudi market, and the challenges and opportunities for investors in various sectors,” Al-Ghamdi said.

“Securing foreign investment and greater institutional involvement will play a critical role in shaping the Saudi capital market into one of the largest, most liquid emerging market investment destinations. We are delighted that the international roadshow has been such a success it is still early in what is a long term process, but the progress so far is very encouraging. ”

Saudi Arabia’s best performing sectors in 2015 are the insurance, energy, and banking/finance sectors, whereas media, retail, and transportation stocks are the worst performing this year, according to data provided by Jadwa Investment.

The number of attendees of the roadshow in all three cities reached nearly 580, in addition to 25 Saudi listed companies, 200 investors and over 500 one-on-one investor meetings, according to a release.