The recently observed uptick in oil prices has given many US shale oil producers the opportunity to expand production, Riyadh-based Jadwa Investment said in a research note on shale production.

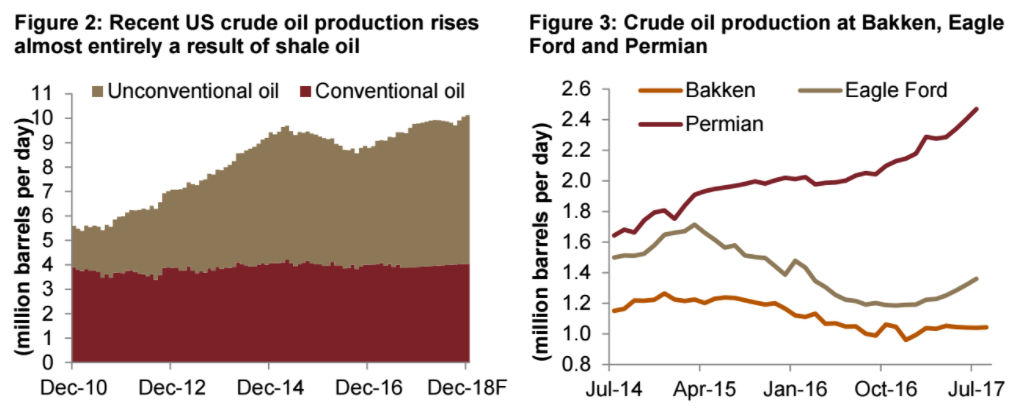

“Latest forecasts from the Energy Information Administration (EIA) see US oil production rising by 10 percent year-on-year in 2017, and 3.3 percent in 2018. Alongside the rise in shale oil production, the financial health of US shale companies has also improved. In addition to the pace of bankruptcies declining noticeably during 2017, there has also been a rebound in the issuance of high-yield debt,” Jadwa writes.

Throughout the period of high oil prices during 2010-2014, access to cheap finance, due to record low US interest rates, helped to sustain US shale oil production rises.

Data via Jadwa Investment.

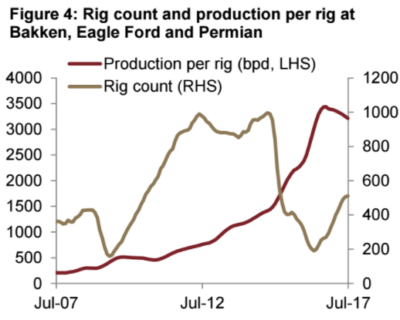

“Going forward, lower interest rates are not likely to persist, with the US Federal Reserve (Fed) already hiking interest rates three times in the last two years,” Jadwa notes. “Besides higher borrowing costs, shale oil producers also face the possibility of constrained capacity leading to inflated operating costs. One area where costs are likely to rise is related to oilfield services, which includes the cost of rigs, equipment and personnel. Despite shale oil operators cutting costs in the last two years, not all of these reductions will be carried forward. As a result, breakeven prices of shale oil are projected to rise for first time in five years, in 2017.”

[Click here to read the full report from Jadwa Investment in English] [Arabic]