A new joint venture between Saudi Arabia’s Ministry of Finance (MoF) and the Islamic Corporation for the Development of the Private Sector (ICD) has received approval to provide loans to low and middle-income Saudis, in what could be a much-needed boost for access to mortgages in the Kingdom.

Bidayaa Home Finance was launched to provide Sharia-compliant mortgages for Saudis, according to a report in The National. Bidaya was granted a mortgage finance license by SAMA last month, making it the first newly established real estate finance company to get such a license.

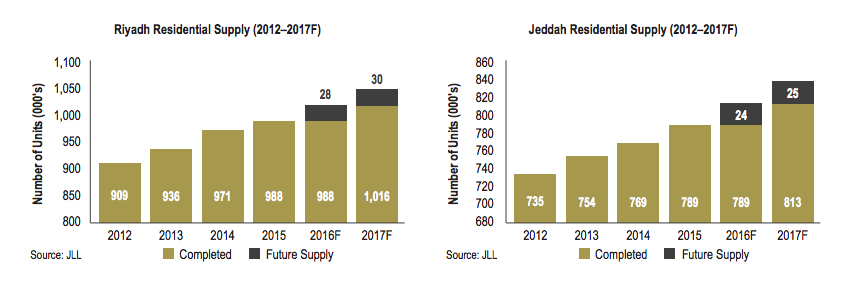

The announcement comes amid a severe shortage of affordable housing in Saudi Arabia. A recently released Jones Lang LaSalle (JLL) report, available on JLL Saudi Arabia’s website, noted that Saudi Arabia had a shortfall of 400,000 affordable housing units. It also revealed that no new affordable housing units were completed in 2015 in Jeddah, Saudi Arabia’s second largest city. 30,000 affordable housing units were either under construction or in the planning stages.

In Riyadh, the limited new supply entering the market has kept vacancy rates stable in 2015, adding upward pressure on rents, JLL said.

A recently announced land tax for property owners was a major step in the right direction for Saudi Arabia’s troubled housing market. The 2.5% fee on undeveloped land within city limits intended for residential or commercial use could raise up to $13 billion (SR50 billion) worth of revenues annually for the government. Those fees will be automatically deposited into an account for the kingdom’s central bank, Saudi Arabian Monetary Agency (SAMA), to fund the development of other housing projects.

In the last year, Saudi Arabia twice made leadership changes at the Ministry of Housing, highlighting the importance of the position in the eyes of Saudi Arabia’s top leaders.

In March, Shwaish bin Saud Dhwaihi was relieved of his post and replaced with Essam bin Saad bin Saeed, who served until December of 2015. Then, Saudi Arabia appointed the western-educated Majed bin Abdullah bin Hamad Al-Hogail to the position. Al-Hogail has a financial and real estate background, having served at the Saudi Arabian Monetary Agency (SAMA) from 1990-1998, and as CEO and Managing Director of the Rafal Real Estate Development Company from 2007 to 2015.

Al-Hogail recently attended and spoke at the Global Competitiveness Forum (GCF) in Riyadh last week.