Jadwa Investment’s recently released Saudi Chartbook for the month of February 2013 assesses a number of key aspects of the Saudi economy including the real economy, bank lending, banking indicators, inflation, trade, oil, exchange rates, the TASI (Saudi Stock Market), sectoral performance, and more.

[The full report from Jadwa Investment can be read here.]

Below are a few key graphs and findings for your consideration.

Real economy: Data for December show that the domestic demand posted a healthy growth. Guides to consumer spending remained strong both in absolute and year-on-year terms. Cement sales were at their all-time high in December.

Labor market: According to the latest labor market survey, the unemployment rate among Saudi citizens reached 12.1 percent in 2012, but with noticeable variations across age groups. The share of Saudis in the labor force has declined in the past two years.

Bank deposits: Bank deposits jumped in line with the usual trend in December. Private sector deposits accounted for most of the gain. While demand deposits continued to grow rapidly, time and savings deposits growth slowed after a double digit growth earlier.

Bank lending: Outstanding bank claims on the private sector reached a record high at the end of December. Lending growth in 2012 was the highest since 2008. Medium- and long-term lending accounted for a greater share.

Inflation: Year-on-year inflation remained flat in December closing last year average at 4.5 percent. Food inflation were on an upward trend for the last 3 months of 2012, but wholesale food prices point toward a subdued domestic pressure in the coming few months.

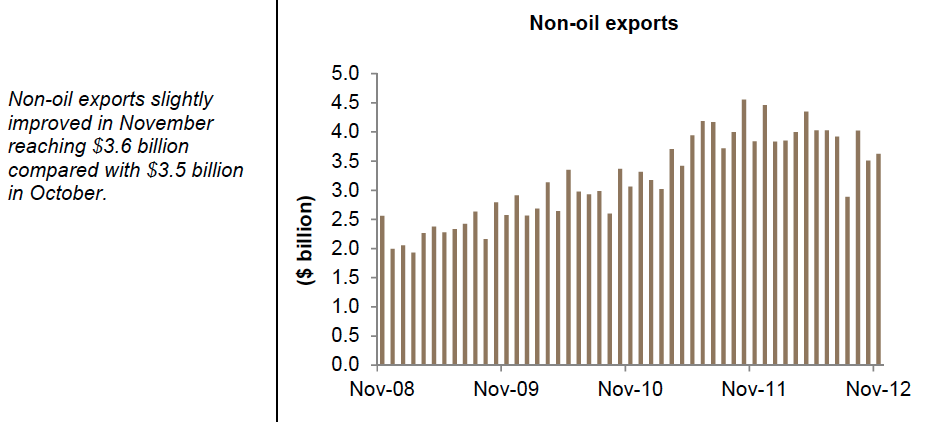

Trade: Both imports and non-oil exports improved in November compared with their level in October. On an annual basis, non-oil exports still lag behind their level a year ago due to lower exports of both petrochemical and plastic products while imports improved.

Oil: Oil prices have trended upward since the start of the year. WTI increased by 6.3 percent year-to-date which slightly reduced the Brent-WTI spread. While Saudi Arabia cut its crude production to a 19-month low, non-OECD oil demand is expected to remain positive.

Exchange rates: While the recent policy actions by Bank of Japan have spurred talk of currency war, positive headline news on the Euro financial health pushed the euro to a higher ground.

Stock market: The TASI maintained its upward trend for the second consecutive month in January, buoyed by strength in global markets.

Sectoral performance: Fourteen of the 15 sectors were up in January. Performance was broadly in line with the fourth quarter results.

Fourth quarter results: Net income of listed companies totaled SR19.7 billion in the fourth quarter. Growth of total earning in 2012 slowed to 1.5 percent year-on-year mainly due to 16.8 percent drop in petrochemical earnings.