Last week the Capital Markets Authority (CMA) confirmed that the Saudi Arabia will open up the region’s largest, diverse and most mature capital market, the Tadawul, to qualified foreign institutional investors (QFIs) by June 15th, 2015. With a market capitalization at $528bn, investors are queueing up and appear “ready to accept the political and financial risks as they finally get access to a market that rivals Brazil and Russia’s,” according to Reuters. Following the announcement, Saudi Arabia’s benchmark stock index sustained its upward trend for the second consecutive week, according to Arab News.

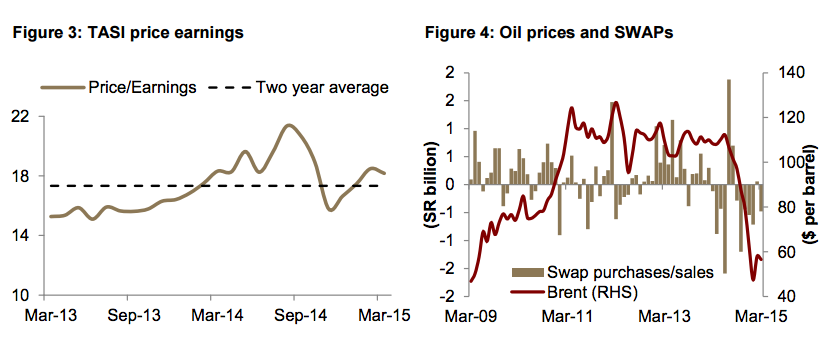

In advance of the opening, Riyadh-based investment firm Jadwa Investment shared a publication addressing the changes that have taken place in the last year leading up to last week’s announcement of firm details on the opening. “Since the publication of our original report back in August 2014, Opening the Tawadul up to Foreign Investors, we have seen a number of developments which have impacted the Tadawul All Share Index (TASI). This includes a massive drop in oil prices which negatively impacted investor sentimental and led to panic selling, and the $6 billion initial public offering (IPO) of the National Commercial Bank (NCB), which amounted to the second-biggest IPO of 2014 globally,” the bank said.

[Click here to read the full report from Jadwa Investment on the Opening of the Tadawul on June 15]