In Jadwa Investment’s recently released report on the Saudi economy, the Riyadh-based finance firm sees limited upside to oil prices for the remainder of the year but increased production leading to growth in Saudi Arabia’s oil sector GDP.

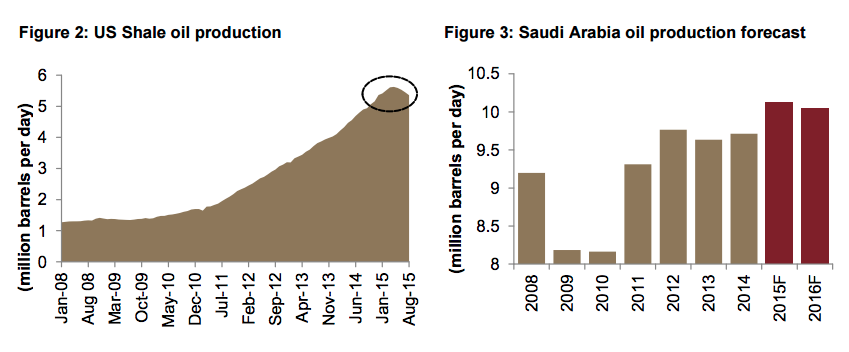

“Brent oil prices year-to-date average is currently 55 per barrel (pb), down 51 percent, year-on-year. The combination of relative resilience in shale oil supply, higher OPEC output and moderate growth in global oil demand will mean limited upside to prices for the remainder of the year,” Head of Research Fahad Alturki writes.

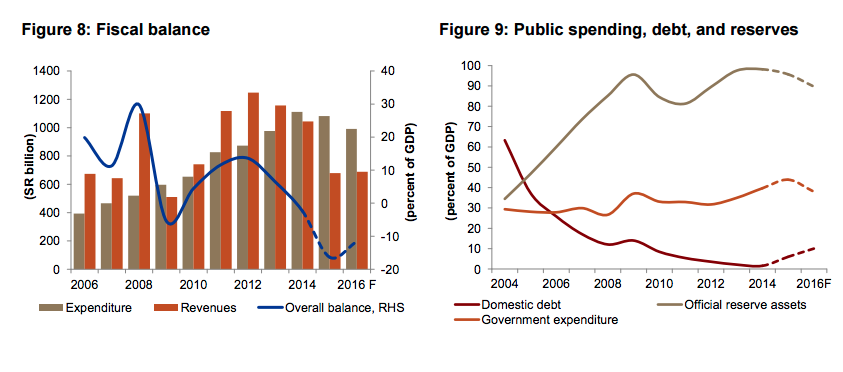

“We expect the government to maintain elevated spending, reducing the current uncertainty regarding fiscal policy in this low oil price environment. The high level of spending on the economy, together with low oil prices, will mean a larger than anticipated fiscal deficit, while the current account deficit will be small in 2015,” Alturki noted in the report. “However, the new government deficit financing strategy of reserve withdrawals and debt issuance will ensure a stable and gradual consolidation in public expenditure as the fiscal balance starts to improve from 2016.”

Other notes from Jadwa in the note to investors:

• 2015 and 2016 forecasts have been revised to take account of a recent flow of data that has generally been slightly weaker than we had anticipated. Specifically we forecast real GDP growth to reach 3.2 percent, and 2.3 percent in 2015 and 2016 respectively, down from 3.5 percent in 2014. The forecast slowdown during 2016 will be driven mainly by changes in oil production and oil sector growth.

• We have revised our forecast for oil sector GDP growth in 2015 following higher than expected year-to-date oil production. We expect annual oil sector GDP growth to increase to 3.4 percent, up from 1.5 percent in 2014. We forecast 2016 growth at 0.2 percent.

• Our forecast for non-oil private sector GDP is 3.8 percent for 2015. Year-on-year growth for non-oil private sector GDP in H1 2015 has slowed to 3 percent, down from 5.8 percent during the same period in 2014, which we believe is partially reflective of the negative sentiment associated with the uncertainty regarding the direction of fiscal policy. We expect non-oil private sector GDP growth to accelerate to 4.7 percent in 2016 as private sector activity increases and adjusts to the new environment of lower oil prices. We believe that the sector will continue to be supported by the government’s sustained commitment to elevated spending as evidenced by the recent series of debt issuance.

• The construction, transport, and retail sectors will continue to lead non-oil sector growth. Construction and transport were the fastest growing sectors in the first half of 2015, growing by 4.5 percent year-on-year. Wholesale and retail and utilities, also posted healthy year-on-year growth above 3 percent.

• We expect the government to maintain elevated spending, reducing the current uncertainty regarding fiscal policy in this low oil price environment. The high level of spending on the economy, together with low oil prices, will mean a larger than anticipated fiscal deficit, while the current account deficit will be small in 2015. However, the new government deficit financing strategy of reserve withdrawals and debt issuance will ensure a stable and gradual consolidation in public expenditure as the fiscal balance starts to improve from 2016.