Saudi Arabia’s Public Investment Fund (PIF) has created a handful of new companies in several sectors in the Kingdom while investing in many others, injecting capital and a new competitor in the housing, energy, waste and recycling, tourism, transportation sectors and more.

As the PIF’s role in the Saudi economy increases, critics say the mega-fund will crowd out private sector investors, and a key element of Vision 2030 is to boost the private sector so the country is less dependent on the government. But the PIF is also strategically injecting needed capital into areas of the Saudi economy that are ripe for investment and must eventually grow and survive without significant government help.

Here’s a look at those new companies and investments that have made headlines recently*:

Construction – A “Super Contractor” Company to Take Over Aramco Projects

Saudi Arabia’s Public Investment Fund (PIF) and Saudi Aramco are planning to set up a “super contractor” in partnership with local and international contractors. According to MEED, the new entity will replace distressed contractors, particularly Saudi Binladin Group and Saudi Oger, which have suffered financial difficulties in recent years and have been forced to scale back their operations.

The new entity is expected to take over major projects announced by the Public Investment Fund such as the Red Sea Project and Jeddah Downtown.The new company will be responsible for the construction projects, which were assigned to Aramco. The construction sector will be separated from the mother company, and it is expected to recruit about 15,000 employees and employees. [Source: Asharq Alawsat]

Tourism/Hospitality – Jeddah/Mecca Development and Red Sea Tourism – Rou’a Al-Haram and Rou’a Al-Madinah Companies

Saudi Arabia’s Public Investment Fund (PIF) is continuing to expand its investment portfolio in Saudi Arabia’s travel, tourism, and leisure infrastructure across different regions of the country as part of the Kingdom’s Vision 2030 economic and social reform plans.

In Jeddah and Mecca, large amounts of PIF cash will help to convert those cities into more visitable destinations for Saudis and travelers from abroad. Redevelopments on Jeddah’s Corniche and on housing and infrastructure in Mecca and Medina will transform the face of Saudi Arabia’s second and third largest cities.

But the largest project for the PIF and the Saudi government is the least developed, and that is part of the draw. The Red Sea Development Project,

That marquee project recently secured its first international investor – billionaire and Virgin Group founder Richard Branson. He made the announcement while visiting Saudi Arabia. [Source: SUSTG.com and others]

Entertainment – Up to $3 billion in a new company to invest in the Entertainment sector

In September, the PIF announced it would create a new company to invest in the entertainment sector with an initial capitalization of SR10bn ($2.7bn). The company will invest in a number of entertainment projects, including “an entertainment complex that will be launched by 2019.” [Source: Forbes]

Mortgages and Housing – Saudi Real Estate Finance Company

The PIF announced today it would set up a real estate refinancing company aimed at boosting home ownership in the kingdom. The Saudi Real Estate Refinance Company (SRC) will help pump liquidity into the real estate financing market.

The company “was launched in partnership with the ministry of housing and has received a licence from the Saudi central bank, the Saudi Arabian Monetary Authority (SAMA), is expected refinance up to 75bn riyals ($20 billion) worth of mortgage debt over the next five years. [Source: The National]

Transportation – Ride-hailing giant Uber and other projects with U.S.-based Blackstone

One of the PIF’s first investments that put it on the international map was a $3.5 billion investment into Uber Technologies, the ride-sharing app that has completely upended transportation industry in less than a decade.

The PIF also announced that it would partner with U.S. private equity firm Blackstone to create a $40 billion vehicle to invest in infrastructure projects, mainly in the United States.

E-Commerce and Online Retail – ‘Noon’ Platform

A group of investors led by Emaar Properties PJSC Chairman Mohamed Alabbar and Saudi Arabia’s sovereign wealth fund will each contribute $500 million to an e-commerce venture to “tap the Middle East’s fast-growing online retail market.” E-commerce firm Noon will go live in January and provide 20 million items for customers, Alabbar said at a news conference in Dubai on Sunday. [Source: Bloomberg.com]

Waste Management and Recycling – Creation of The Saudi Recycling Company

Saudi Arabia has announced it will establish a recycling sector company that will “protect the Kingdom’s environment and encourage recycling through alliances with private sector industries.” [Source: The National]

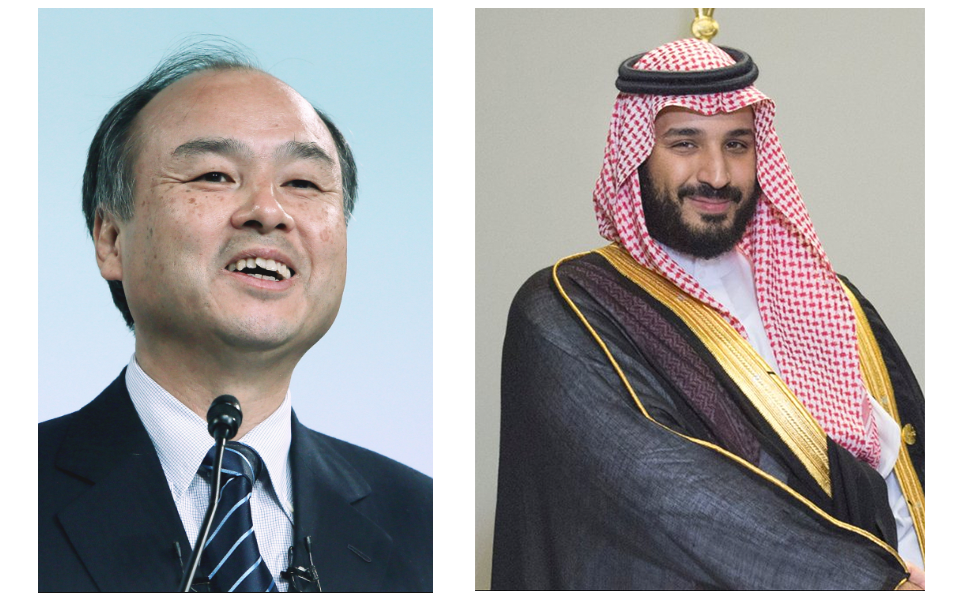

Technology – Investment in SoftBank’s “Vision Fund”

Japanese billionaire Masayoshi Son, chairman of Softbank, a telecommunications and tech investment group, revealed plans for the fund last October and since then it has obtained commitments from some of the world’s most deep-pocketed investors, as well as Saudi Arabia’s Public Investment fund.

In total, the fund may top $100 billion. [Source: Reuters]

*Editor’s note: this article will be updated with reader feedback and further details as they become available. See something missing? Email us at newsreview@SUSTG.org