Economic data for Saudi Arabia for the month of August revealed a number of “positive developments” in several areas, according a recently-released monthly chartbook report by Jadwa Investment.

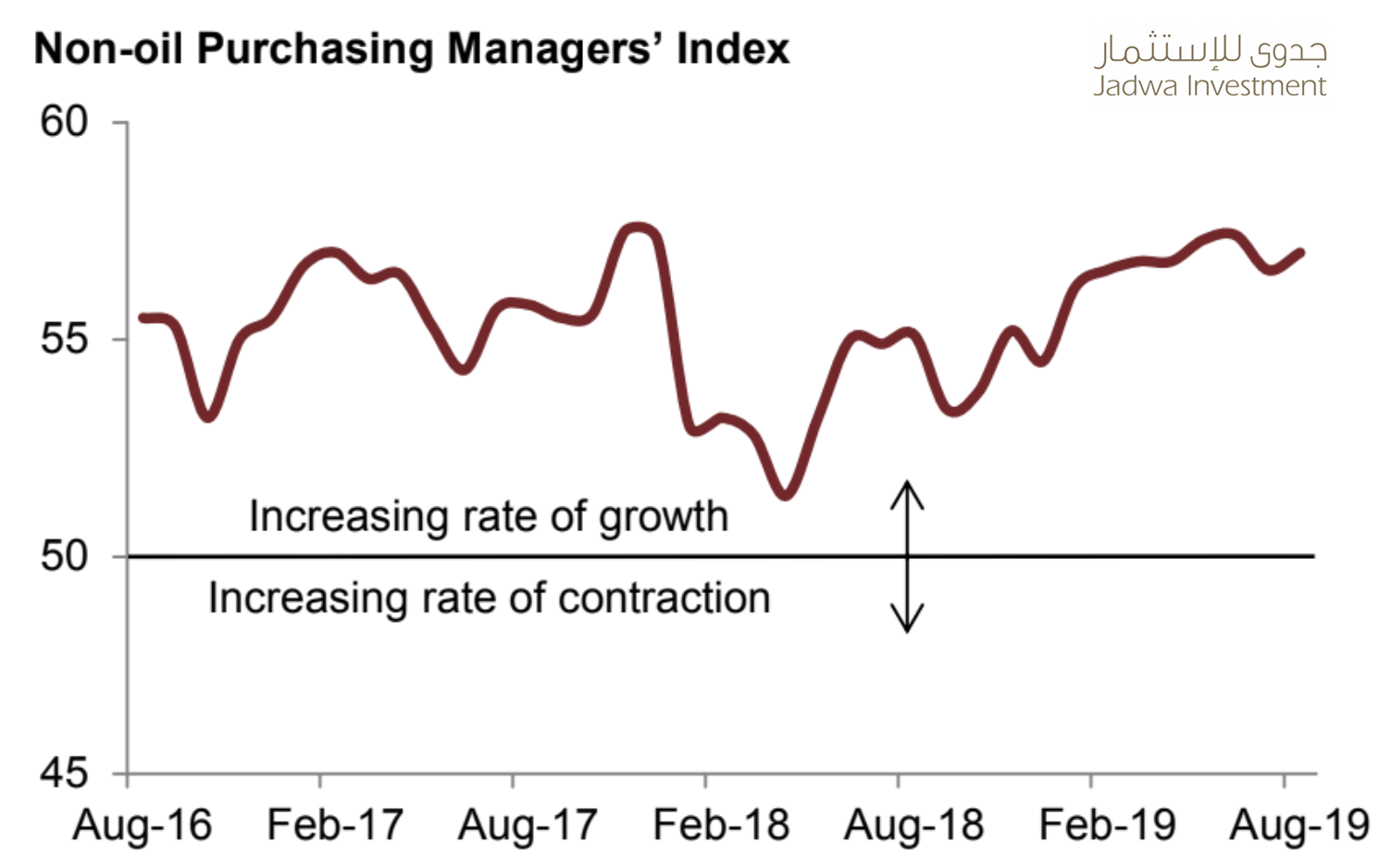

The Riyadh-based bank noted that POS transactions rose by 18 percent year-on-year, while non-oil PMI index edged up, and cement sales and production rose by 12 percent and 16 percent respectively in August, year-on-year.

The Kingdom saw an increase in SAMA FX reserves, edging up by $4.5 billion month-on-month to stand at around $508 billion in August. Total bank claims rose by 6.3 percent in August year-on-year and Credit to the private sector rose by 2.8 percent, year-on-year.

Inflation in Saudi Arabia continued to decline in August, by 1.1 percent year-on-year.

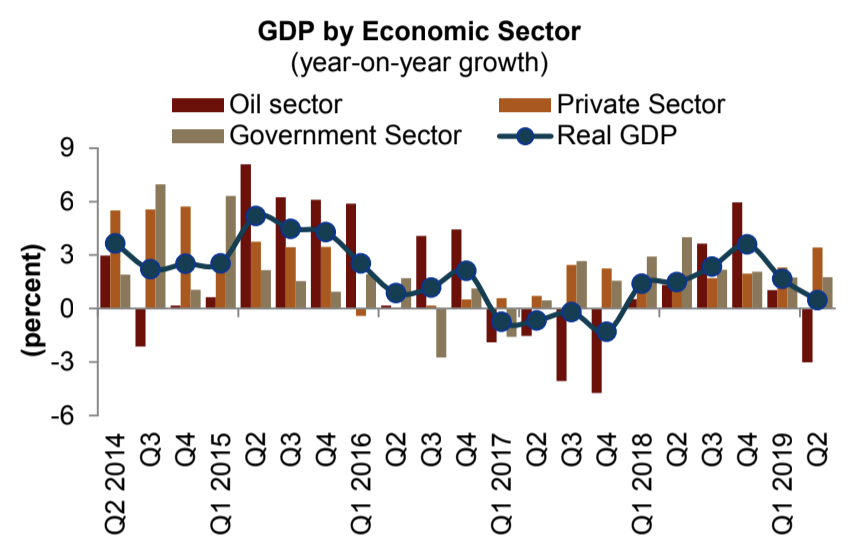

Data on Q2 2019 real GDP

showed that the economy

expanded by 0.5 percent,

year-on-year, Jadwa said.

The Kingdom also saw slightly positive movement on a key indicator for success of its Vision 2030 program: employment. The Saudi unemployment rate declined in Q2 2019 to 12.3 percent, driven by a drop in youth (20-24 years old) unemployment.

On the negative side, data on Q2 2019 real GDP showed that the expanded by 0.5 percent, year-on-year, Jadwa said. The oil sector declined by 3 percent, while non-oil private sector GDP was up 3.4 percent.

[Click here to read the full report from Jadwa Investment] [Arabic]

*Editor’s note: we’ve corrected this article to reflect a correction from Jadwa Investment. The previous version of Saudi Chartbook – October 2019 erroneously stated that the Saudi economy contracted by 0.5 percent year-on-year, and total expat levies in the manufacturing sector waived by the government were the equivalent of around SR39 billion for the period between 2019-2023. Jadwa has corrected this to state that the Saudi economy expanded by 0.5 percent year-on-year, and total expat levies in the manufacturing sector waived by the government were the equivalent of around SR27 billion for the period between 2019-2023.