The latest Macroeconomic Update report from Jadwa Investment examines the impact of the COVID-19 virus, or Coronavirus, on the Saudi economy, noting that while COVID-19 will put pressure on the oil economy, downside risks to non-oil growth will also be noticeable in the Kingdom.

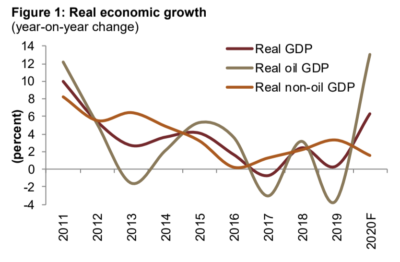

Real economic growth. Graphic via Jadwa Investment.

While Jadwa still expects “non-oil growth to be reasonable, at 1.6 percent, and non-oil private sector growth at 1.8 percent, developments around COVID-19 will temporarily derail the momentum in year-on-year non-oil growth. More specifically, we see lower than previously anticipated growth in the ‘Transport, Storage & Communication’, ‘Wholesale/Retail Trade & Restaurants/Hotels, and ’Other Manufacturing’ sectors.”

While economic pain will be felt around the world, the onset of a global recession and a fall of oil prices only validates the Saudi leadership’s decision to enact the Vision 2030 economic reform program and goal of diversifying its economy. While Saudi Arabia has more progress to go with diversification, the progress that has been made will help to alleviate the pain of the current fall in oil prices on the Saudi economy.

As Jadwa notes, “[m]ore positively though, we see progress under various VRPs, many of which have 2020 commitments, directly contributing to growth in a number of sectors during the year. So, under the Public Investment Fund (PIF) program, we expect growth in the construction sector as a result of progress on mega-projects, whilst the combination of the Financial Sector Development Program and Housing VRP will help push growth in the housing and mortgage finance sector.”

“On the fiscal side, in light of developments related to the outbreak of the COVID-19 and its expected impact on oil demand and prices, we now view the budgeted SR833 billion revenue by the Ministry of Finance (MoF) as being more realistic than previously thought. According to our calculations, we see government revenue being slightly lower than that anticipated by the MoF, at SR791 billion. At the same time, with total expenditure budgeted at SR1.02 trillion, we see the fiscal deficit totaling around SR229 billion (7.8 percent of GDP) at the end of the year, higher than SR187 billion (6.4 percent of GDP) deficit outlined in the MOF’s budget statement late last year,” according to Jadwa.

[Click here to download and read the report from Jadwa Investment] [Arabic]