Saudi Arabia’s central bank governor said it’s “too early” to tell if the Kingdom’s economy will bounce back with a V-shaped recovery as the government loosens coronavirus-related restrictions, according to a Bloomberg report.

Saudi Arabia has spent big and taken significant, proactive steps to mitigate the effect of the Coronavirus pandemic and low oil prices on the Kingdom’s economy. According a report in Reuters on Sunday, Saudi government initiatives to support the financing of the private sector to mitigate the impact of the coronavirus outbreak have exceeded 51 billion riyals ($13.60 billion) so far, the central bank said on Sunday.

The Kingdom has also tripled its VAT in order to start generating more income flow for the government to continue apace with modernization and economic reforms.

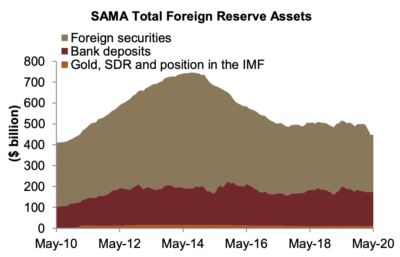

SAMA FX reserves rose marginally month-on-month in May, by almost $0.7 billion, following a 3-month decline by $53 billion.

Still, the Coronavirus pandemic has upended much of the Saudi economy and economic planning. The annual Hajj pilgrimage, in which Saudi Arabia plays host to millions of Muslims worldwide to conduct the sacred rites, has been all but cancelled. The cautious decision by Saudi authorities has brought grief among pilgrims who dream of the opportunity for the once-in-a-lifetime pilgrimage to Mecca. Instead of over a million visitors this year, the Hajj will be only a thousand low-risk local pilgrims. It is also hit to the Saudi economy as the Kingdom is expected to lose billions of income.

The economic effect felt by Saudi Arabia is similar to others worldwide who took proactive measures to curb the spread of Coronavirus by locking down societies. But for Saudi Arabia, the blow is doubled as oil prices tumbled to new lows earlier this year, although they have rebounded considerably due to Saudi leadership in organizing fresh output cuts from the OPEC+ group of companies. Part of the goal of Vision 2030 is to eliminate Saudi Arabia’s dependance on oil for revenue, but to get there, the Kingdom needs to use oil revenues to grow a number of other sectors into sustainable revenue-generating industries.

The Saudis have deep foreign reserves to weather the storm, and although Saudi Arabia has drawn down on those funds in recent months, reserve levels grew last month for the first time since January. Alkholifey said reserve levels are “still comfortable” and could be supported with “more positive signals coming from the oil market, which we see right now”

Saudi Arabia is reopening virtually all facets of its economy despite a rise in the spread of the Coronavirus. Restrictions had been in place since mid-March and their gradual lifting has allowed commercial businesses and public venues to reopen, but that has containment of the spread of the disease more challenging. Saudi Arabia’s coronavirus infections have passed 200,000.

According to an interview conducted with Bloomberg, Saudi officials “believe in the resilience of the Saudi economy,” and consumer spending data has seen a pickup since the kingdom’s reopening in late May, Saudi Arabian Monetary Authority Governor Ahmed Alkholifey said, while noting there are still a number of downside risks.

“We see light at the end of the tunnel yet we remain vigilant, to be honest,” Alkholifey said.