According to latest OPEC forecasts, “the worst seems to be over with respect to global oil demand” as expectations of a rebound for the second half of this year and a positive forecast for 2021 brighten outlooks, a recent report from Riyadh-based Jadwa Investment says.

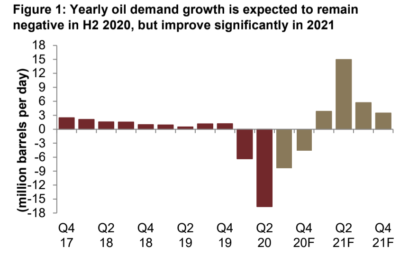

While “H1 2020 saw an average yearly decline in oil demand by nearly 12 percent, H2 2020 is expected to see declines of around 6 percent year-on-year. Overall, oil demand is expected to decline by 9 million barrels per day mbpd (or 9 percent) year-on-year in 2020,” according to Jadwa Investment. “More promisingly, OPEC forecasts yearly oil demand in 2021 to rebound by 7 mbpd (or 8 percent) to an annual average of 97.7 mbpd, although it will still be below the pre-pandemic level of 99.7 mbpd seen in 2019.”

Graphic via Jadwa Investment.

“On the supply side, OPEC and partners (OPEC+) historic crude oil production agreement back in April was followed through with exceptional levels of compliance. May and June average compliance stood at 99 percent. Following last week’s Joint Ministerial Monitoring Committee (JMMC), OPEC+ decided to raise output gradually over the course of this year on the back of encouraging signs of improvement in oil demand,” Jadwa writes.

Looking ahead, “we see some upside to prices going forward, especially as oil demand progressively rises during H2 2020. That said, the upside will be capped by i) the existence of large commercial oil inventories and ii) the risks associated with rising cases of COVID-19 or indeed a second wave,” according to Jadwa.

Jadwa Investment also says it has “cautiously raised” its Brent oil forecast to $43 per barrel (pb) for 2020, versus $39 pb previously.

[Click here to read the full report from Jadwa Investment] [Arabic]