After a strong finish to 2020, oil demand will continue rising in Q1 and during the rest of the year on a quarterly basis, but still end up 3 percent lower than pre-COVID-19 levels by the end of 2021, a recent report by Jadwa Investment on the market said.

Global oil demand recovered in the last three months of 2020 after the global pandemic sapped demand, with OPEC reporting rises of 3 percent quarter-on-quarter in Q4 2020. Oil demand is likely to continue to recover gradually in 2021 as suppliers carefully navigate global demand recovery.

Oil is expected to recover in 2021, but still fall short of pre-2020 levels.

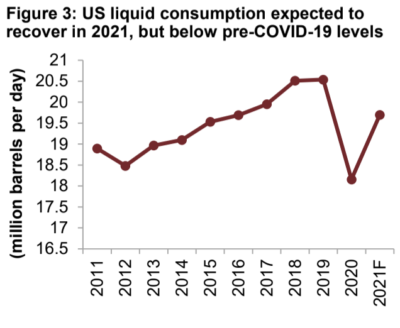

In the U.S., (21 percent of global oil demand), the Energy Information Administration’s (EIA) data shows that total energy consumption rose by 1 percent quarter-on-quarter (or 130 tbpd) in Q4 2020, but was 10 percent lower than the same period last year, Jadwa notes.

A large part of the recovery in 2020, and looking forward into 2021, will depend on supplier coordination on output cuts, led by Saudi Arabia, to boost prices.

“OPEC and partners (OPEC+) maintained strong levels of commitment to the production agreement in Q4, with average compliance at around 100 percent. That said, differentiated levels of compliance between the two blocs (OPEC/non-OPEC) has been a reoccurring theme of the last seven months,” Jadwa said. “Looking ahead, OPEC+’s initial decision (late last year) to raise oil output by only 0.5 million barrels per day (mbpd) for the month of January, together with a unilateral cut by Saudi Arabia to the tune of 1 mbpd in both February and March, means the alliance’s output should decline marginally in Q1 2021. Beyond that, we expect OPEC+ to raise oil output by 1.4 mbpd at some point during Q2.”

Already in 2021, Brent oil has risen further, with Saudi Arabia’s unilateral reduction in output lifting prices around 10 percent.

“Looking ahead, the recovery in oil prices during the remainder of the year will not be linear, not least because of the risks still associated with COVID-19. Bearing this in mind, we have left our full year 2021 Brent oil price forecast of $55 pb unchanged,” Jadwa says.

[Click here to read the full report from Jadwa Investment] [Arabic]