Economic indicators for the Saudi economy from the month of January continued to point to a recovery in the non-oil sector, Jadwa Investment says in its latest Chartbook detailing the fundamentals of the Kingdom’s economy.

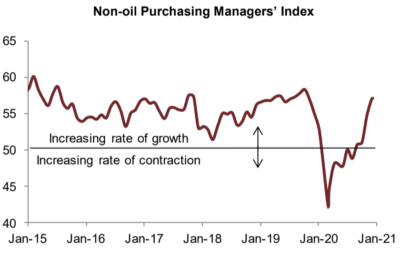

Saudi Arabia’s PMI rose marginally month-on-month to reach 57.1, a fifth consecutive monthly rise. POS transactions continued to show strong yearly rises in January, while ATM withdrawals continued on a downward trend.

PMI started the year with an upward trend reaching a 14-month high at 57.1. Graphic via Jadwa Investment.

SAMA FX reserves declined by $3.5 billion month-on-month in January, to stand at $450 billion.

“Looking ahead, we expect an improvement in the current account (due to higher oil receipts) and financial account inflows related to two recent international bond issuances to push up FX reserves in the near term,” Jadwa noted.

Additionally, the rise in the price of oil over the months of January and February was seen as positive for the Kingdom, which is still working to diversify its economy away from crude exports. Oil prices rose sharply in February as extreme weather conditions in Texas, led to a drop in US crude oil output. Brent oil was up 15 percent and WTI was up 11 percent month-on-month. Saudi crude oil production averaged 9.1 mbpd in January, a rise of 1.4 percent month-to-month.

Saudi Arabia’s stock market, the TASI, rose 5.1 percent month-on-month in February, as optimism around rising oil prices pushed the Saudi index to its highest level in almost two years.