Saudi Arabia’s stock exchange will likely end the year with more than 30 new listings as the Kingdom’s IPO bonanza in 2021 continues, according to comments from the Kingdom’s head of its Capital Markets Authority Mohammed El-Kuwaiz.

El-Kuwaiz made the comments on Monday at a conference in Riyadh, according to Reuters.

Saudi Arabia’s stock exchange, also called the Tadawul, announced its conversion into a holding company with four subsidiaries earlier this year in advance of its own initial public offering this year. It appointed JP Morgan, Citigroup, and the securities arm of Saudi National Bank for its initial public offering, according to Reuters.

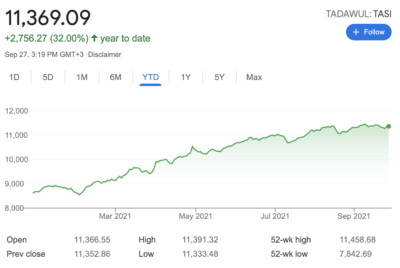

The Tadawul is up 32% YTD.

The Tadawul is up 32% YTD.

In January 2020, state-owned oil giant Saudi Aramco kicked off the beginning of a run of IPOs in Saudi Arabia, raising a record $29.4 billion. Throughout 2020, the kingdom generated IPO proceeds worth $1.45 billion despite the economic fallout from the pandemic. As Reuters noted in a report earlier this year, four out of seven IPOs from Gulf countries in 2020 launched on Saudi Arabia’s Tadawul bourse, the largest market in the region with average daily turnover in excess of 8 billion riyals last year, according to data from EFG-Hermes.

This year, five companies have launched IPOs on the Saudi stock market so far: Arabian Internet and Communications Services Co., Shatirah House Restaurant Co., Tanmiah Food Co., Theeb Rent a Car Co., and Alkhorayef Water and Power Technologies Co.

More IPOs are in the immediate pipeline. The $1.2 billion IPO by ACWA Power International, set to price later this month, is reportedly drawing high interest from investors “looking for exposure to businesses seen as key to the kingdom’s plans to diversify its economy away from oil,” Bloomberg reports.

ACWA Power would be the biggest offering in Riyadh since Aramco’s listing.