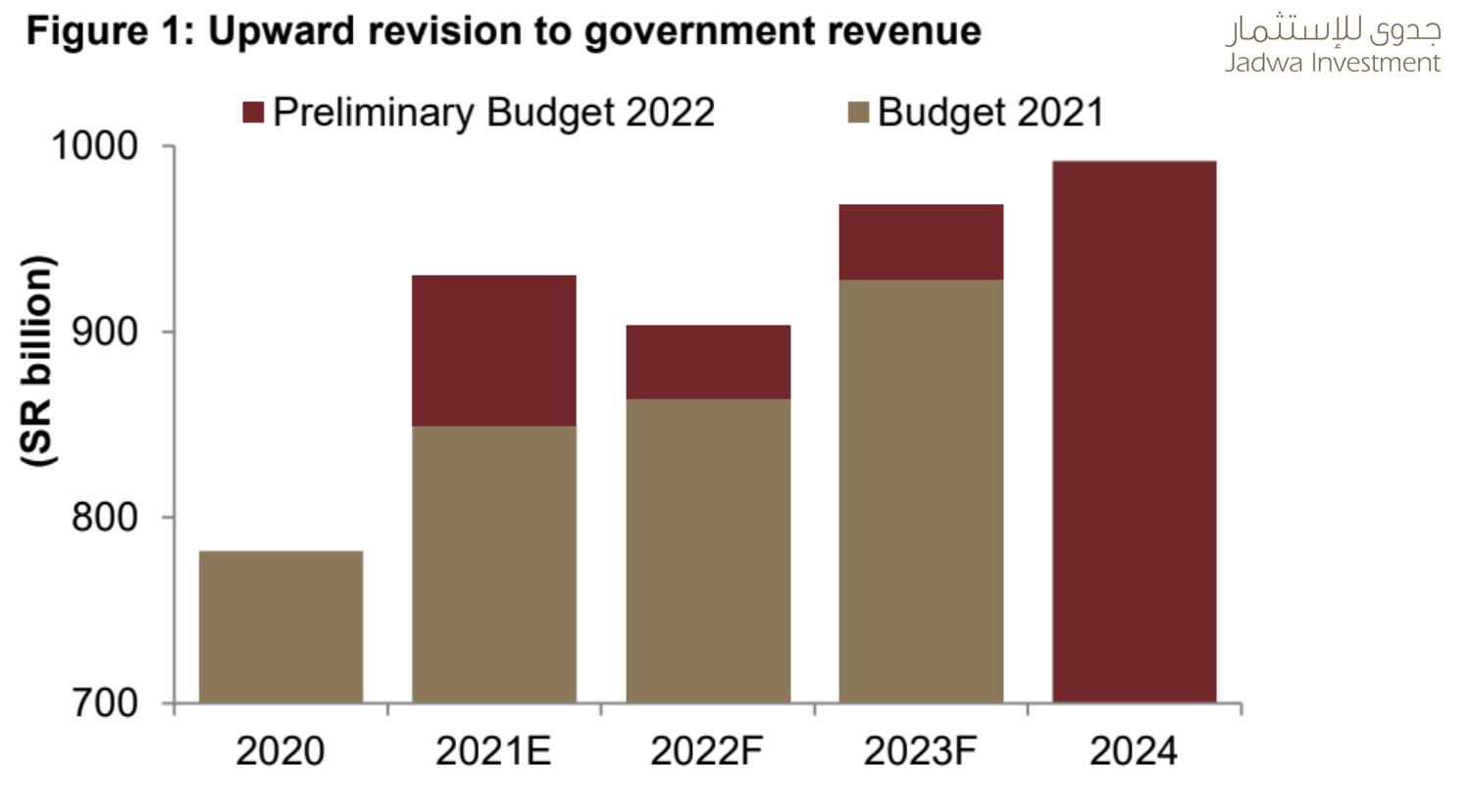

Saudi authorities released a preliminary budget statement for the 2022 fiscal year on 30th September 2021, and some fiscal and economic indicators were revised for the medium term.

According to a report and analysis by Jadwa Investment, the main adjustment to Saudi Arabia’s fiscal outlook “relates to government revenue, with the upward revision to revenue from 2022 onwards being related to higher than budgeted oil revenue, in our view,” the Riyadh-based investment bank said in an emailed note.

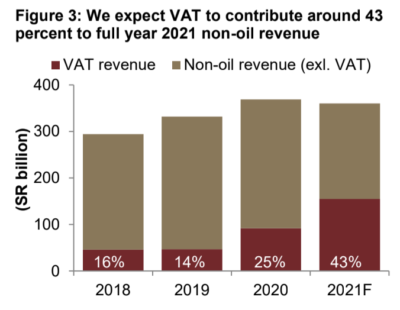

Jadwa says it expects VAT to contribute around 43

percent to full year 2021 non-oil revenue.

“Value added tax (VAT) revenue remains a key component of non-oil revenue. In fact, we estimate that income from VAT will contribute around 43 percent of full year 2021 non-oil revenue, up from 25 percent last year and 14 percent in 2019. Overall, we believe the Ministry of Finance (MoF) has taken a conservative approach in budgeting oil and non-oil revenue. Indeed, we surmise that the revenue forecasts from 2022 onwards do not assume the continued payment of Aramco special dividend,” Jadwa said.

On the expenditure side, the only change in MoF’s forecast relates to the current year, with government expenditure projections for 2022 and 2023 “reflecting the MoF’s more prudent approach to fiscal affairs, in-line with the Fiscal Sustainability Vision Realization Program (VRP),” according to Jadwa.

As a result of the revisions, the Kingdom’s 2021’s fiscal deficit is expected to narrow to -SR85 billion (or -2.7 percent of GDP) vs. -4.9 percent of GDP previously. Saudi Arabia is also forecasted to see a fiscal surplus in 2023, one year earlier than previously projected, at SR27 billion (or 0.8 percent of GDP), with this being sustained into 2024.

The MoF now sees average annual real GDP growth of 4.6 percent during 2021-23, versus 3.4 percent over the same period previously.

[Click here to read the full report from Jadwa Investment] [Arabic]