Oil reached a 2015 high on Monday as Brent hit $67.10 a barrel, a sign of an oil price rebound fueled by regional chaos, global demand increases, and speculation of looming cuts in Saudi output.

“No one can set the price of oil – it’s up to Allah,” Saudi Arabia’s Minister of Petroleum and Natural Resources Ali Al Naimi told CNBC, on the sidelines of the Euromoney Conference in Riyadh. Naimi said that he cannot predict the price of crude going forward, saying, “If I knew, I would be somewhere else gambling.”

“Speculators influence short changes in price. But in the long term, supply and demand control the price,” Naimi said.

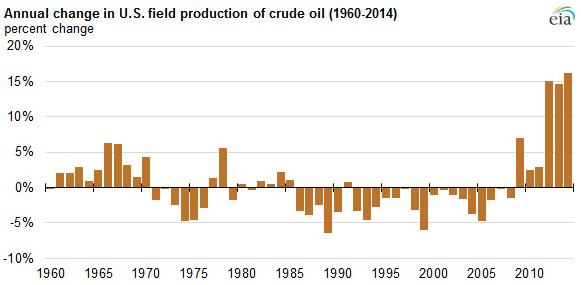

Shale production has increased in the United States, but increased Saudi output has caused many shale producers to wait out the low prices in oil.

Saudi Arabia has been pumping crude at record levels in order to maintain market share and cull higher-cost producers including shale producers in the United States.

It’s been an eventful 30 days for the all-important energy sector in Saudi Arabia. In a shakeup of key government positions last week, Saudi Arabia’s King Salman appointed Khalid al-Falih as Chairman of Aramco amid a restructuring of the company, which is wholly owned by the Saudi government. Ali Al Naimi is still the Minister of Petroleum and Natural Resources.

A similar change had been made in neighboring Qatar, where the head of the Energy and Industry Ministry was separated from the executive leadership of Qatar Petroleum. On the surface, keeping the Ministry and its regulatory authority separated from the company it is tasked with regulating may increase transparency for Saudi Aramco and empower the Ministry to increase focus on other challenges, including domestic energy consumption.

Saudi Arabia kept June prices for its benchmark Arab Light crude unchanged for Asian buyers, according to Reuters. On Tuesday, U.S. crude settled up $1.47 at $60.40 a barrel, after hitting 2015 high of $61.10.