Bank of America (BofA) Global Research has hiked its forecast for Brent crude oil prices for this year, citing tighter supplies due to the Texas freeze and OPEC+ output curbs and unmatched global monetary stimulus, Reuters reports, citing a research note from the bank.

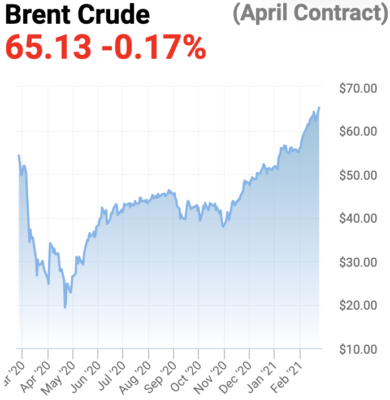

BofA now expects Brent crude oil to average $60 per barrel in 2021, up from a previous estimate of $50. BofA also forecasts West Texas Intermediate (WTI) crude prices to average $57 a barrel this year. The bank also noted that Brent prices could “temporarily spike to $70 a barrel in the second quarter of the year.”

Brent Crude’s price as of 2/24/2021 at 10:48am EST.

Last week, the Wall Street Journal reported that Saudi Arabia, the world’s largest oil producer, plans to increase oil output in the coming months as a nearly year-long recovery in oil prices is giving the Kingdom confidence that the market has improved enough to reverse a recent big production cut. Saudi Arabia orchestrated a comeback for the commodity after a significant price fall in early 2020 as the pandemic gripped the global economy and a price war drove the price of oil on the Brent crude index to just $19 a barrel in April.

Brent crude was up 0.4% at $65.51 a barrel by 1313 GMT, and U.S. crude rose 0.5% to $62.00 a barrel.

“The big Texas freeze in the past week should reduce global inventories by an additional 50 million barrels, further supporting (oil) prices,” BofA said. The bank also said Saudi Arabia’s additional, voluntary oil output cuts in February and March and the Organization of the Petroleum Exporting Countries and allies (OPEC+) holding production steady were also supportive, according to Reuters.

Saudi Arabia plans to announce that it will raise production when a coalition of oil producers meets next month, but the output rise won’t kick in until April. Plans to raise prices were not final.

According to Reuters, the BofA research note said biggest short-term downside risk to oil prices “may come from a new Iran deal, which could bring 2 million bpd into the market in short order.”