Saudi Arabia’s Capital Market Authority has further tightened its restrictions on anonymous investors trading shares through brokers in a bid to prevent money laundering and financing of militant groups, Reuters reports.

The new rules apply to Saudi and Gulf-based brokers and banks “which offer opportunities to invest in the Saudi stock market through funds called ‘nominee accounts’. Under these arrangements, investors pool their money and the broker buys indirect ownership in stocks through participatory notes,” according to Reuters.

The move comes just a few months after Saudi Arabia opened its stock market to wider foreign investment to qualified firms that obtain permits.

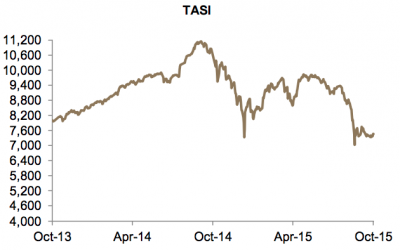

Saudi Arabia’s stock market has seen substantial volatility in 2015 due to a host of external forces, including a decline of oil prices from mid-2014 highs, impacts from global markets, regional conflicts, and the opening to Qualified Foreign Investors (QFIs). The TASI fall slightly in September month-on-month.

[Click here to read the full Reuters report]