With a bleak outlook for oil demand growth in 2020 by OPEC, and recent pledged cuts agreed to by the so-called OPEC+ group of producers last week, Saudi Arabia is set to produce about 2 million barrels per day less on average compared to previous forecasts, Jadwa Investment writes in a new quarterly oil market update.

“[W]e now expect Saudi crude oil production to average 9.4 mbpd during 2020, down from our previous forecast of 11.4 mbpd,” Jadwa writes. “Shortly following the OPEC+ deal, oil producing nations within the Group of 20 (G20) announced additional reductions in output totaling up to 3.7 mbpd. However, the lack of detail surrounding these reductions makes it very difficult to assess whether such reductions are guaranteed, raising the risk of persistent sizable daily oil surpluses during Q2.”

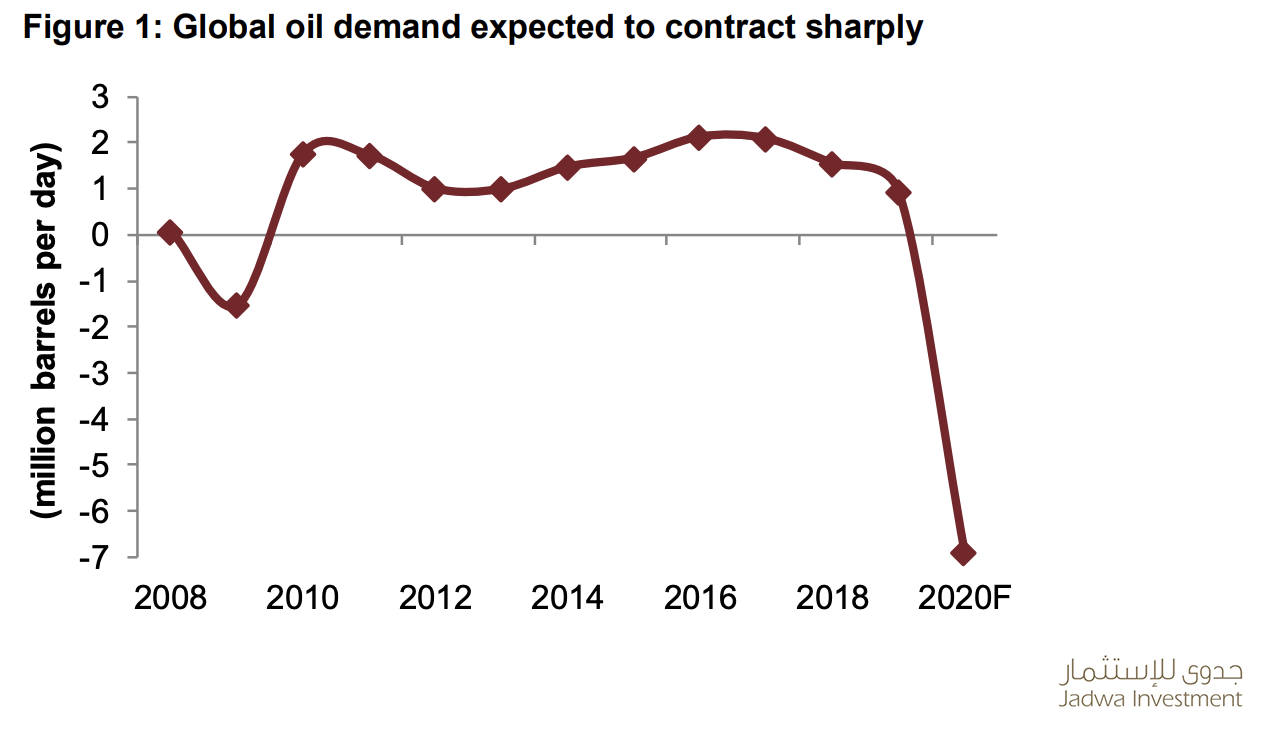

OPEC expects an average decline in demand of 6.9 mbpd over the course of the year.

“As such, commercial oil stocks could rise closer to maximum capacity levels at some point during Q2, with the rate of stock build accelerating if OPEC+ exhibits poor compliance levels. If this unfolds then oil prices will trend even lower, forcing some oil producers to make tough choices around shutting-in wells, and permanently taking their oil off-line. In light of this, we have revised down our Brent oil forecast to $39 per barrel (pb) for 2020, from $44 pb previously,” Jadwa notes.

Riyadh-based Jadwa Investment updated its economic forecasts for Saudi Arabia accordingly to incorporate recent developments in oil markets as well as the domestic response to COVID-19.

“We now expect overall GDP to contract by 1.7 percent with the non-oil private sector declining by 3.9 percent. On the fiscal front, lower oil and non-oil revenue as well as higher expenditure than budgeted is expected to push the fiscal deficit to SR422 billion (or 15.7 percent of GDP) in 2020,” according to the report.

[Click here to read the full report from Jadwa Investment] [Arabic]