Saudi Arabia’s total government accounts with SAMA fell $80 billion last year, representing a significant slowdown from 2015 which saw a $116 billion net decline, according to a recently released chartbook by Jadwa Investment.

The net monthly change to government accounts with SAMA remained negative in December, falling for the seventh consecutive month, part of what Jadwa called a “mixed picture” for the Saudi economy in the month of December.

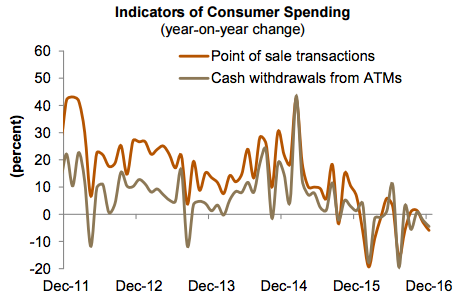

December cash withdrawals form ATMs and POS transactions fell by 4.5 percent and 6 percent, year-on-year respectively, Jadwa notes.

“Consumer spending indicators remained negative, year-on-year. Meanwhile, the non-oil PMI ended 2016 with an improvement from record lows witnessed in previous months,” Jadwa said.

Among the other findings in the report:

–SAMA FX reserves ended 2016 at $536 billion, falling by $80 billion during the year. This represents a notable improvement compared with the $116 billion net decline during 2015.

-December growth in bank credit to the private sector fell to its lowest level since March 2010.

-Inflation continued to show a sharp downward trend in December, arriving at 1.7 percent. We expect inflation to have turned negative in January, marking a return to deflation for the first time since 2005.

-Annual Saudi crude oil production averaged 10.5 mbpd in 2016, the highest on record for at least 30 years.

-The US dollar saw losses against most major currencies in January as a number of controversial and protectionist policies implemented by the new US president reduced investor’s appetite for the currency.

-The TASI was down marginally, by 1.2 percent, month-on-month in January, as worse than expected listed company results dampened sentiment.

-Net-income of listed companies in Q4 2016 was down 8 percent year-on-year and 43 percent quarter-on-quarter.