Saudi Arabia will experience a broad-based economic recovery in 2021 as the Kingdom moves beyond the damage caused by the Coronavirus pandemic and low oil prices, Jadwa Investment said in a recent research note.

The Riyadh-based bank’s expectations for the Kingdom’s economy come despite a “considerable degree of uncertainty” surrounding the Coronavirus and vaccination roll-outs across Saudi Arabia.

“Looking out into 2021, while there is still a considerable degree of uncertainty as a result of the prevalence of COVID-19 and its potential impact on the non-oil economy, we nevertheless expect a broad-based recovery. Our forecast assumes between 15-20 percent of the adult population being vaccinated against COVID-19 by mid-2021, and 70 percent by year end. As such, we see a quarter -on-quarter improvement in the Saudi non-oil economy, with this recovery being more vigorous in the second half of 2021.”

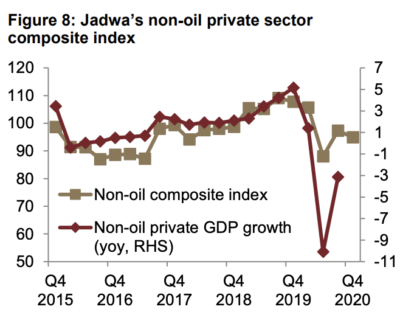

Non-oil private sector index for Saudi Arabia.

Jadwa says it sees an expansion in the Wholesale and Retail, Restaurants and Hotels sector, especially as restrictions around social distancing are gradually relaxed and there is a steady pick-up in entertainment and domestic tourism activities. Jadwa also sees a rebound in Construction and Transport, Storage and Communication sectors contributing to growth. “In construction, the sector should continue benefitting from work on a number of Public Investment Fund’s (PIF) mega-projects. In transport, the economic benefits from the completion of SR87 billion worth of projects during the year will help push sectorial GDP up. Included within this is the much anticipated Riyadh metro, as well as the Riyadh Rapid Bus Transit System,” Jadwa said.

On the still all-important oil sector, Jadwa said that the Kingdom’s strict adherence to OPEC and partners (OPEC+) crude oil production targets in 2020 “most likely pushed the oil sector’s share in total GDP to the lowest level on record. Looking ahead, a unilateral reduction in oil output by the Kingdom during most of Q1 and continued compliance with the OPEC+ agreement will not help raise the sector’s contribution by a huge amount in 2021. That said, some growth is expected to come from the opening of the Jazan refinery. Additionally, the full year effects from the Fadhili gas complex and an expansion of the Hawiyah gas processing plant will also contribute to oil sector growth.”

On the fiscal front, Jadwa says it estimates “that higher yearly oil prices and the continued payment of dividends by Aramco will raise government oil revenue to SR491 billion. At the same time, we expect non-oil revenue to be effectively flat on a year-on-year basis, at around SR360 billion, taking total government revenue to SR851 billion in 2021.

“With expenditure expected to decline by 7 percent year-on-year to SR990 billion, as per the recent budget statement, we see the fiscal deficit narrowing to -SR139 billion or -4.8 percent of GDP. Meanwhile, the government expects to issue additional new debt to the equivalent of SR83 billion, pushing total public debt to SR937 billion (32.8 percent of GDP) at the end of 2021,” Jadwa said.

[Click here to read the full report from Jadwa Investment on the Saudi Economy in 2021] [Arabic]