Fintech Saudi, an initiative launched by the Saudi Central Bank (SAMA) in partnership with the Capital Market Authority (CMA), has announced the results of the National Fintech Adoption Survey, a first of its kind measurement in Saudi Arabia of the people’s interest in adopting fintech solutions.

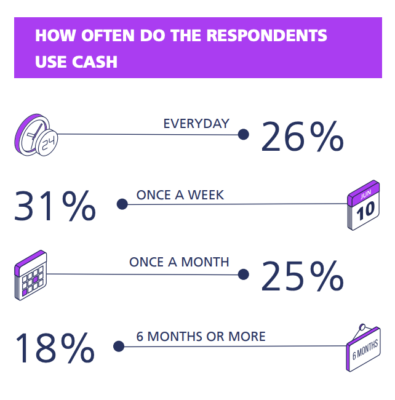

Cash use in Saudi Arabia is declining, but still prevalent, the survey found.

Fintech is a relatively new term that refers to the integration of financial technology into offerings by financial services companies in order to improve their use and delivery to consumers.

“Since the launch of Fintech Saudi, we are pleased to have seen the fintech industry in Saudi Arabia advance forward. Whilst supporting the growth of the fintech industry, we also need to evaluate the demand for fintech solutions, track the level of fintech adoption and understand the barriers that are preventing more users from embracing fintech solutions,” the survey says in a published document with its findings. “The National Fintech Adoption Survey is the first of its kind in Saudi Arabia and was conducted by Fintech Saudi at the beginning of 2021 to measure the level of fintech adoption in the Kingdom and understand how the fintech industry is supporting individuals and companies.”

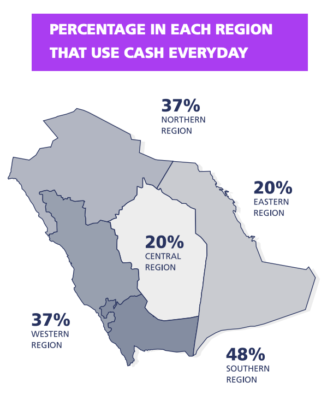

Cash use varies by region in Saudi Arabia.

The survey conducted presented results in the following five areas in the fintech space: ‘cash usage’; ‘fintech activity’; ‘banking relationship’; ‘ESG’; and ‘open banking’.

The survey’s key findings reveal interesting facts about how money is spent currently in the Kingdom. The majority of the population in Saudi Arabia, for example, still uses cash once a week. But the trend is digital: overall cash usage is declining, the report said.

The report found that 3 out of 4 individuals in Saudi Arabia have used at least one fintech solution – but age, tech savviness and regional disparities remain.

Additionally, the report found that only 2 out of 10 customers visited their bank branch in the last month and 93% of customers primarily conduct their banking activities electronically. 9 Out of 10 customers trust their primary bank relationship and 84% believe that they receive a good service from their bank.

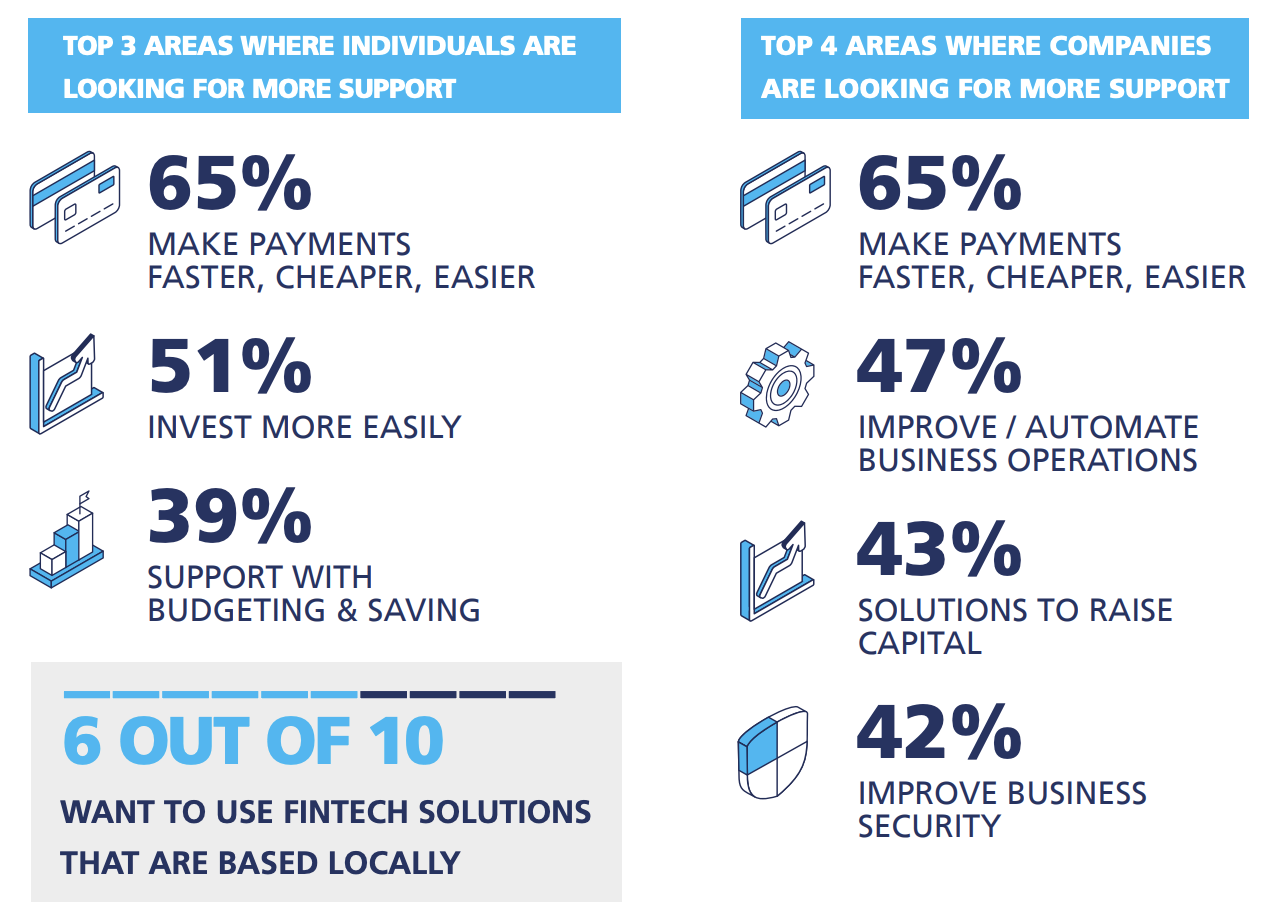

Companies were looking for solutions that could help them improve their business activities, the report said.

The report also revealed that e-payments activity is the biggest contributor to fintech adoption.

“A major target of Saudi’s Vision 2030 is to move towards a cashless society and increase the number of non-cash transactions to 70% in 2025,” the report says. “The COVID-19 outbreak has led to an acceleration in cashless activity with digital payments increasing by 75% over the last year, whilst cash withdrawals from ATMs and other payment points have declined by 30% over the same period.”

[Click here to download and read the full report from Fintech Saudi (PDF)]