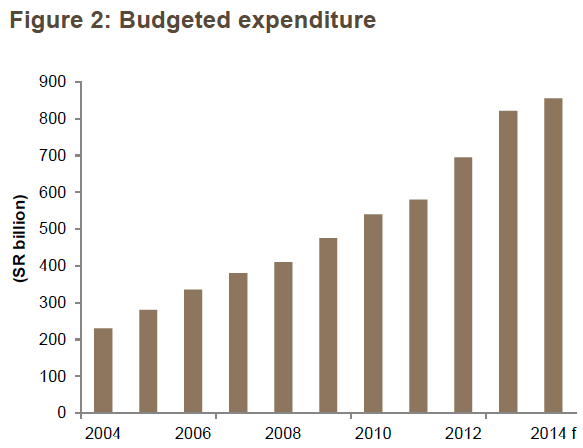

Each year brings the announcement of a new historic budget for Saudi Arabia with an increase in spending higher than its predecessor. In fact, there is nothing permanent in the economy, and there is nothing permanent in government spending. For Saudi Arabia, government spending depends on oil prices, and the continued expansion of the budget is done on the back of high oil prices. When we look at oil prices over the previous three years, we find that it settles above $100 a barrel, and to maintain annual spending requires an increase in the price of oil each year. In order to maintain a balanced budget in 2014 without additional spending, the average oil price next year must be $87 a barrel, compared with $42 in 2006.

SOURCE: Jadwa Investment

Even with high demand, one should be aware that global production is rising, too. The production of shale oil in the United States, the restructuring of the oil sector in Mexico, more oil produced from non-member countries of the Organization of Petroleum Exporting Countries, the raising of the ceiling of the expected production from Libya and Iraq, and the possibility of lifting part of sanctions to prevent the export of oil from Iran are all factors to consider. So, even with high demand for oil globally, there are many new sources of production that could drive the price down lower.

Salaries of employees in the Saudi public sector have increased by more than 25 per cent since the late 2000s, as a result of adjustments to the cost of living and rising inflation. But further efforts to raise the salaries of public sector employees and hire more workers is unsustainable because 37 percent of public expenditure allocated to public sector salaries is equivalent to 51 percent of current expenditures, and therefore is not prudent to increase employment in the public sector any more than is necessary.

SOURCE: Jadwa Investment

The total amount of salaries paid today for the public sector is very close to Saudi Arabia’s entire government budget for 2005. Government salaries should not rise unless productivity from the public sector rises too. All government agencies without exception and all government officials should be required to work together in order to achieve efficiency in government spending.

The onus is on the private sector in creating jobs for Saudis. The Saudi private sector has benefited for several decades of government support through spending and lending, protection, and huge amounts of investment, at still the public sector is the main engine of employment. At the end of the decade, there will be more than 2.5 million Saudi looking for jobs.

The state must spend more efficiently while working to prolong many of the capital projects over the next several years. These capital projects with strategic value to the state cannot be rushed to completion in two or three years – doing so will make efficiency of spending to complete these projects difficult and affect the quality of the result. Through negligence in the management of spending, we harm future generations, so the government should adopt policies that are more disciplined in spending starting now. Smaller budgets that are more efficient are a sign of fiscal health.

![]()

Dr. John Sfakianakis is the Chief Investment Strategist of MASIC, the Riyadh-based investment and asset management company. At MASIC he is responsible for managing the company’s investment portfolios and strategy, across multiple sharia compliant asset classes. He joined in February 2013.

Dr. John Sfakianakis is the Chief Investment Strategist of MASIC, the Riyadh-based investment and asset management company. At MASIC he is responsible for managing the company’s investment portfolios and strategy, across multiple sharia compliant asset classes. He joined in February 2013.

Previously, he held the post of Chief Economic Advisor at the Saudi Ministry of Finance. He also served as Chief Economist for Banque Saudi Fransi (BSF) and also Chief Economist, Middle East North Africa region for Credit Agricole C.I.B, the foreign joint-venture partner of BSF. He served as the Chief Economist of The Saudi British Bank (SABB) in Riyadh, a joint venture with HSBC and also worked for Samba Financial Group as its Chief Regional Economist. He has also worked for the United Nations (UNDP) and the World Bank as an economist in Washington, D.C.

His articles appear frequently in the Financial Times, New York Times, Wall Street Journal and Bloomberg. He holds a Ph.D. in economics from Harvard University.

Editor’s Note: This article originally appeared in Arabic on the Saudi news website Aleqtisadiah. SUSTG.org is pleased to feature this analysis and commentary by Dr. Sfakianakis as translated from his weekly columns.