The “new reality” of lower crude prices means governments in the Gulf – and especially Saudi Arabia – are right to cut spending to reflect this new fiscal reality, the IMF said.

The IMF slashed its forecast for growth in Saudi Arabia, as it blamed the slowing Chinese economy, the collapse in oil prices and a slowdown in emerging markets for a cut to the overall economic outlook for the world. Saudi Arabia’s economy will grow at just 1.2 percent in 2016, and 1.9 percent the year after, according to IMF forecasts, which are both one point below October estimates.

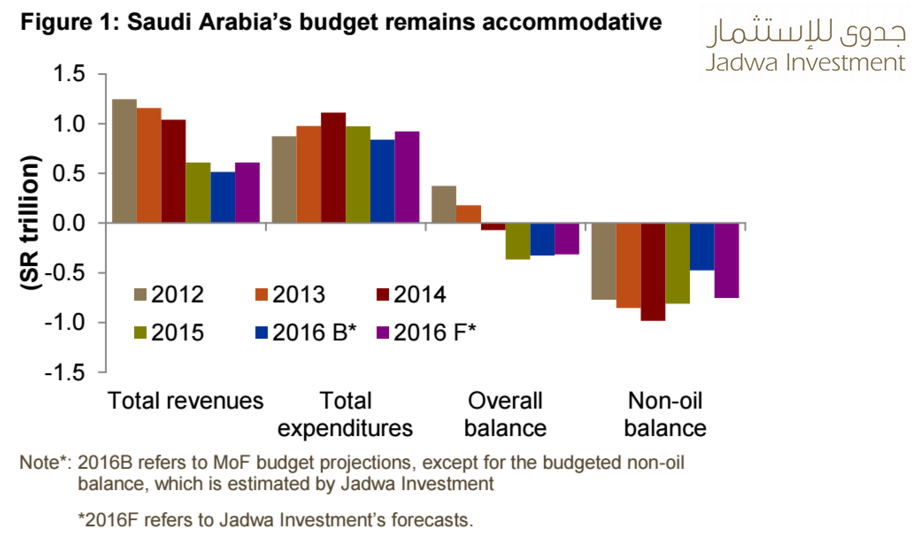

Saudi Arabia announced its 2016 budget with slightly reduced spending plans, but it is far from being accurately characterized as “austerity.” The government budgeted for a $86 billion deficit in nominal terms, based on revenues of $137 billion and expenditures of $224 billion.

In 2015, Saudi Arabia’s deficit was the largest on record, however, reduced spending “has meant a much smaller than anticipated deficit. This is the second consecutive fiscal deficit, and was mainly due to both a steep fall in revenues and a rise in one off expenditures associated with the royal succession,” according to Jadwa Investment.

Forecasted expenditures are down only slightly for 2016 over 2015, but 2016 is the first year in at least a decade when forecasted expenditure is set to decrease year on year.

King Salman announced that Saudi Arabia will continue to diversify revenue sources away from oil, which may include subsidy cuts and other measures once considered to be politically difficult for Saudi Arabia.

According to a phone interview with IMF’s Middle East chief Masood Ahmed, Saudi Arabia’s fiscal consolidation has been more ambitious and speedier “than what had been anticipated earlier, and one of the consequences will be to see dampening effect on non-oil growth,” Bloomberg reports.

“This consolidation, along with the other measures that have been signaled on privatization and restructuring of the economy, should also lay the basis for stronger growth,” Ahmed said. The measures are “a set of actions that we think are necessary given the new reality of lower oil prices,” he said, according to Bloomberg.