Saudi Arabia saw a rebound in some economic data points after Coronavirus-driven shutdowns, according to the latest Jadwa Investment August 2020 Chartbook.

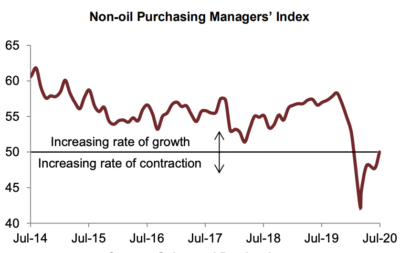

The Kingdom’s non-oil PMI rose to 50 in July, the highest level since March, “indicating better sentiment in the private sector after months of contraction,” Jadwa notes.

“Meanwhile, cement sales and production rebounded by 94 and 82 percent year-on-year in June, respectively, affected by easing in lockdown restrictions and a likely pick-up in construction activity.”

Saudi Arabia also saw POS transactions rebound sharply in June by 78 percent year-on-year, due to increased activity ahead of the Kingdom’s implementation of a significant increase in the VAT. Jadwa notes that the latest weekly data shows POS transactions slowing in July, since the VAT’s implementation.

Non-oil PMI rose to 50 in July, the highest level since March, after contracting in June for the first time in three months, Jadwa Investment said.

Saudi Arabia’s SAMA FX reserves declined by $1.9 billion month-on-month in June, to stand at $447.4 billion. The net monthly change to government accounts with SAMA showed a rise by SR19 billion ($5 billion) month-on-month in June.

Saudi Arabia continues to make steady, positive progress in reducing the spread of the Coronavirus within its borders, which bodes well for the Kingdom’s overall economy as it moves forward with Vision 2030 economic and social reforms. Saudi Arabia announced 1,567 new cases of the disease on Friday, down from a peak of 4,900 in late July.

[Click here to read the full report from Jadwa Investment] [Arabic]