Riyadh-based Jadwa Investment’s December 2015 Saudi Chartbook finds a ‘mixed picture’ for Saudi domestic economic activity. While data on consumer spending pointed to healthy growth, PMI fell to its lowest point on record.

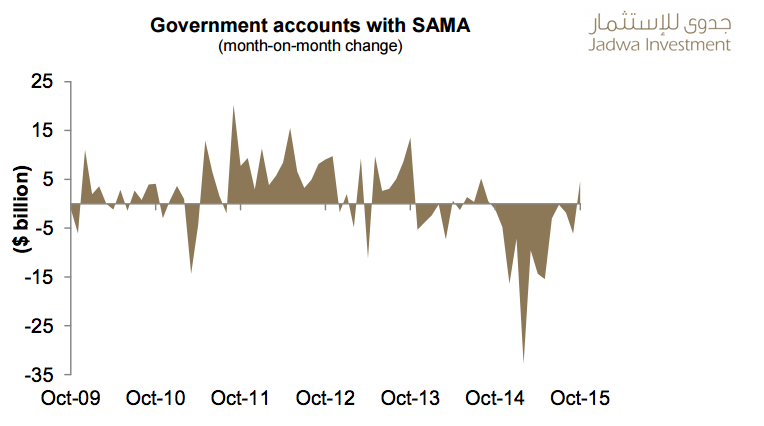

The Data also show the first positive net monthly change to government accounts with SAMA:

- Real Economy: October data showed a mixed picture for domestic economic activity. Data on consumer spending point to healthy growth, while PMI fell to its lowest point on record.

- Government Finance: In October, the net monthly change to government accounts with SAMA came out positive for the first time in eleven months. We think this improvement was due to a shift in financing from government accounts at SAMA to withdrawing deposits from domestic banks.

- Foreign Reserves: SAMA foreign reserves fell to $644 billion in October. However, the net monthly withdrawals continued to be smaller than the first half of 2015.

- Banking Indicators: In month-on-month terms, bank lending to the private sector rose by 0.8 percent. Total bank deposits fell by SR 51 billion, dragged down by net monthly withdrawals from both the private sector and the government. The loan-to-deposit ratio rose to 83.7, its highest point since 2009.

- Inflation: Inflation continued to edge upwards for the third consecutive month to reach 2.4 percent in October. Housing inflation was again the main force behind this rise as it accelerated to 4.4 percent.

- Trade: In September, non-oil exports continued to trend downwards due to weaker global demand in 2015. Imports continued to post a year-on-year decline as well, both in value and volume terms.

- Oil-Global: Brent oil prices averaged $43 per barrel (pb) during November, down from $48 pb (-9 percent) in the previous month.

- Oil-Regional: Saudi Arabian crude production was flat month-on-month, at around 10.2 mbpd in October. We do not see any significant policy change at the OPEC meeting in early December.

- Exchange Rates: The dollar/riyal peg remains under speculative pressure despite ample government reserves and a clear commitment by SAMA to maintain the peg..

- Stock Market: The TASI rallied by 3 percent, month-on-month, in November as it became apparent that it had been oversold in the previous three months.

- Volumes: November turnover in the TASI was flat, month-on-month.

- Sectorial Performance: Ten out of the 15 sectors in the TASI saw positive performance in the month of November.

In addition to the above observations, the Chart book includes Jadwa’s monthly update on trade, trends within the regional and global oil markets and an overview of market performance.

[Click here to read the full Jadwa Investment December 2015 Chartbook]