Jadwa Investment’s Saudi Chartbook for the month of November 2012 assesses a number of key aspects of the Saudi economy including the real economy, bank lending, banking indicators, inflation, trade, oil, exchange rates, the TASI (Saudi Stock Market), sectoral performance, and third quarter earnings.

To read the entire report in full as a PDF, click here.

Real economy: Indicators of consumer activity slowed in absolute value in September, but maintained a positive trend compared to their values a year ago. Cement sales rebounded in September as construction activities picked up owing to improved weather.

Bank lending: Bank lending to the private sector posted another rise in September. Services and commerce sectors are set to be the largest recipient of new funds this year. Bank holding of treasury bills continue to moderate as inflationary pressure eases.

Banking indicators: Total deposits expanded at a higher rate than bank lending. As a result, the loan-to-deposit ratio slightly declined to 82.5 percent. Monthly profits of local banks slowed for the second consecutive month but year-to-date profits remained healthy.

Inflation: Year-on-year inflation fell slightly to 3.6 percent in September compared with 3.8 percent in August. This was almost entirely due to slower rent inflation which eased to 7.2 percent in September while food prices accelerated to 4.4 percent.

To read the entire report in full as a PDF, click here.

Trade: Both imports and non-oil exports fell in August. Within the non-oil exports, the decline is due a 29 percent year-on-year drop in petrochemical exports while imports slowed on the back of lower food and clothe imports.

Oil: While oil prices slightly fell in October on the back of weaker economic sentiment, we expect geopolitical risks to keep firm prices over the coming months. Saudi Arabia slightly lowered its production in October, while non-OECD demand maintained a positive trend.

Exchange rates: The Fed’s monetary easing policy and the gloomy euro area outlook kept the Euro hovering in a small range in October. Other global central banks also seem ready to rise liquidity, most notably bank of Japan.

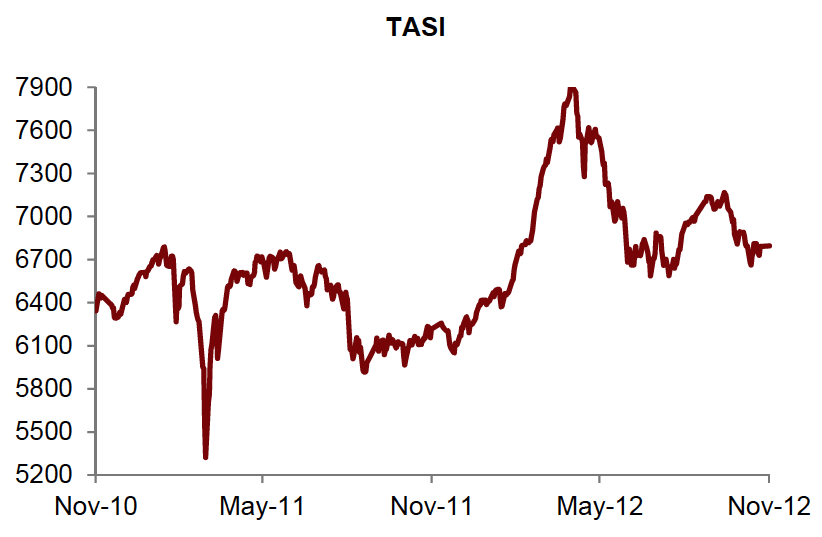

Stock market: The TASI slightly fell in October, though at a slower pace than in the previous month. The decline came in line with a downtrend in global stock markets and oil prices. Average daily turnover dipped by 18 percent month-on-month to SR5 billion.

Sectoral performance: Seven of the 15 sectors were up in October. Strong domestic demand supported telecoms, energy and retail sectors while global outlook weighed on petrochemical sector.

Third quarter earnings: Net income of listed companies totaled SR26.8 billion in the third quarter. Improving corporate performance and new listings was reflected in aggregate net income hitting a record high, resulting in reasonable gains in year-on-year terms.