Jadwa Investment’s recently-released April 2020 Saudi Chartbook highlighting latest data for the Kingdom’s economy shows indications that the Coronavirus will have a negative impact on the economy as Saudi Arabia locks down to safeguard its citizens.

Although the data show a “mixed” picture, Jadwa notes, with POS transactions and cash withdrawals up, the non-oil PMI declined for the third consecutive month in February, affected by a slowdown in new orders.

The net monthly change in government accounts with SAMA declined by SR14 billion ($3.72b) month-on-month in February. SAMA FX reserves were down month-on-month in February, to stand at $497 billion.

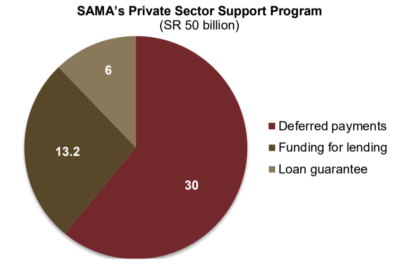

SAMA introduced a program with 3 main initiatives to support SME funding and reduce lending costs throughout 2020. Graphic via Jadwa Investment.

“We calculate foreign reserves would be able to cover up to 47 months of Saudi imports,” Jadwa said.

Bank deposits rose by 7.7 percent year-on-year in February, but inflation also ticked up. Prices rose in February by 1.2 percent year-on-year, and by 0.3 percent month-on-month. Prices in “food and beverages” rose by 3.4 percent, while “housing and utilities” prices declined by 0.7 percent, year-on-year, Jadwa notes.

To face the economic fallout of the global economic slowdown resulting from the spread of the Coronavirus, the Kingdom unveiled a stimulus package to alleviate pain for businesses and citizens amounting to 120 Saudi billion riyals ($32 billion).

[Click here to read the full report from Jadwa Investment] [Arabic]