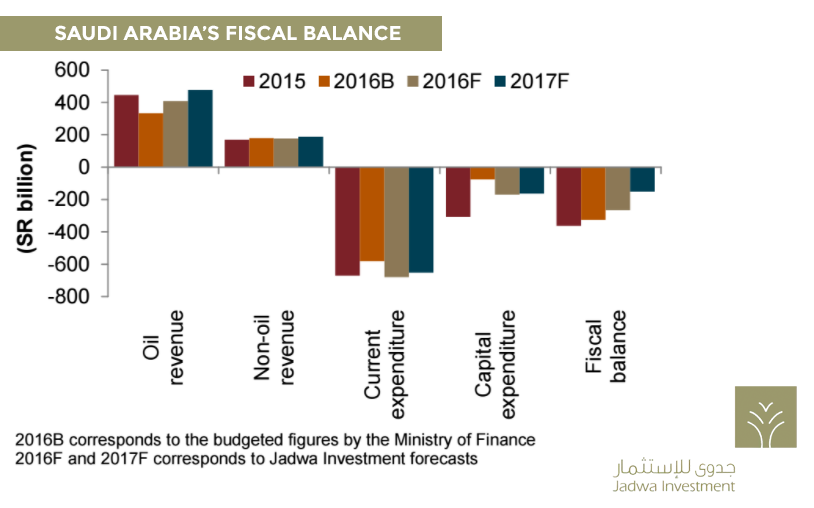

Jadwa Investment’s recently released macroeconomic update for the Kingdom’s economy finds that “prudent policies” have been taken to reform the fiscal budget.

The Riyadh-based bank said that “fiscal consolidation, coupled with improved non-oil revenues, will mean a smaller-than-anticipated fiscal deficit in both 2016 and 2017. This consolidation will, nevertheless, negatively impact private sector activity, thereby leading to lower growth in non-oil GDP.”

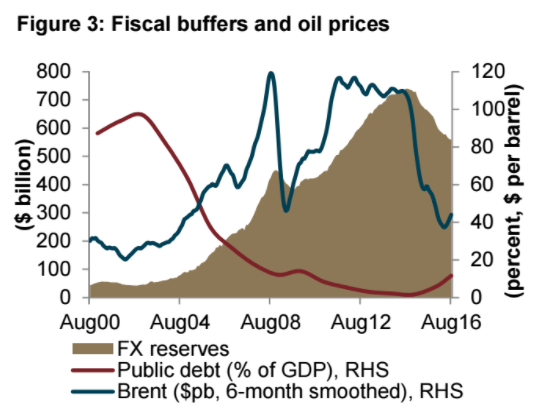

The bank also noted that the commencement of an international sovereign bond issuance program will “have the dual benefit of protecting FX reserves and reducing pressure on domestic liquidity” for Saudi Arabia.

Fiscal buffers and oil prices in Saudi Arabia. Graphic via Jadwa Investment.

More highlights from the report:

-The Ministry of Finance will also take steps to gradually register, list, and trade government debt instruments in the Saudi stock exchange, thereby establishing a benchmark yield curve.

-Meanwhile, the current account deficit is also forecast to be smaller than anticipated, mainly due to lower-than-expected value of imported goods and services.

-Along with the international bond issuance, several other efforts by the government have halted the sharp rise in the cost of funding, as interbank rates have stabilized recently.

-Despite the hike to energy prices at the end of 2015, inflation continued on a decelerating trend, which we believe is reflective of the slowdown in consumption.

[Click here to read the full report from Jadwa Investment]