In an analysis of official data from the Kingdom, Bloomberg found a significant year-on-year reduction in Saudi Arabia’s budget deficit from Q1 2017, a sign that the Kingdom’s economic reforms coupled with an uptick in oil prices have positively impacted the government’s balance sheet.

According to Saudi Arabia’s finance ministry and as reported in Bloomberg, the budget deficit for the three months to March was 26.2 billion riyals ($7 billion). That compared with 91 billion riyals ($24 billion) in the period a year ago. Quarterly revenue rose 72 percent to 144.1 billion riyals ($38 billion), while expenses fell 2.5 percent to 170 billion riyals ($45 billion), the ministry said.

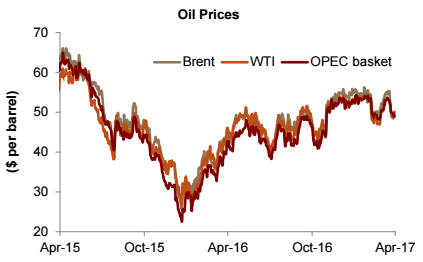

Oil Prices since 2015, graphic via Jadwa Investment.

Saudi Arabia said it hopes to balance its budget by the year 2020. Earlier this week, in an interview published with Reuters, deputy minister for economy and planning Mohammed Al Tuwaijri said the Kingdom is “still comfortable and committed to balancing the budget in 2020.”

According to the Bloomberg report, while Finance Minister Mohammed Al-Jadaan said the report indicates the plan is on course, it also shows that oil still dominates public finances — its share of total revenue grew in the period — making the kingdom susceptible to price swings.

The report also noted that the Saudi government is “shifting to quarterly statements on the economy — having typically reported only annually — to boost transparency as it implements its economic plan, dubbed Saudi Vision 2030.”