According to Chainanalysis’ 2024 Geography of Cryptocurrency Report The Middle East & North Africa (MENA) region ranks as the seventh-largest crypto market globally in 2024.

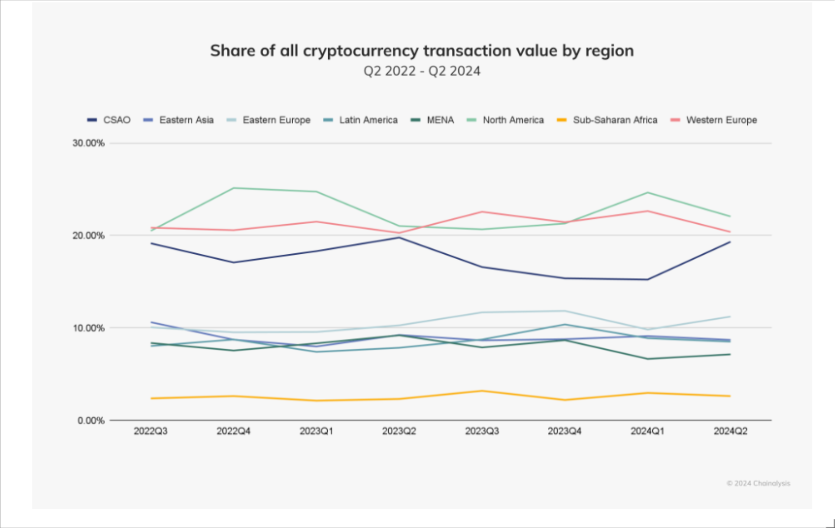

In it’s informative September 25, 2024 article Middle East & North Africa: Regulatory Momentum and DeFi Fuel Adoption the Chainanalysis Team finds that the MENA region is the seventh-largest crypto market globally in 2024, with an estimated $338.7 billion in on-chain value received between July 2023 and June 2024, accounting for 7.5% of the world’s total transaction volume.

“Although the market is smaller compared to other regions, MENA includes two countries ranked in the top 30 of the global crypto adoption index: Türkiye (11th) and Morocco (27th), capturing $137 billion and $12.7 billion of value received, respectively. The majority of crypto activity in MENA is driven by institutional and professional-level activity, with 93% of value transferred consisting of transactions of $10,000 or above.” Chainanalysis Team, Middle East & North Africa: Regulatory Momentum and DeFi Fuel Adoption

Middle East & North Africa: Regulatory Momentum and DeFi Fuel Adoption

Saudi Arabia continues to be the fastest-growing crypto economy in MENA growing 154% year-over-year, with a focus on blockchain innovation, central bank digital currencies (CBDCs), gaming, and fintech innovation.

Key points from Chainanalysis’ report include:

• Centralized exchanges (CEXs) remain the primary source of crypto inflows across MENA overall, indicating that most users and institutions still prefer traditional crypto platforms, but decentralized platforms and DeFi applications are steadily gaining traction.

• Saudi Arabia and the UAE demonstrate high interest in decentralized platforms. The majority of DeFi activity across MENA occurs on DEXs, with Saudi Arabia participating in other DeFi activities at a marginally higher share than other nations.

• Saudi Arabia, a G20 economy with a population of over 30 million, benefits from a disproportionately young population — around 63% of its citizens are under 30 years old. This demographic is especially meaningful from an emerging technology perspective, as younger generations tend to be more open to experimenting with new financial technologies.

• The UAE’s proactive and collaborative regulatory approach to crypto and web3 companies has attracted a diverse range of users, and solidified the UAE as a hub for DeFi and broader crypto activity.

• Across MENA, stablecoins and altcoins are gaining market share over traditionally preferred assets like bitcoin and ether, particularly in Türkiye, Saudi Arabia, and the UAE, which have higher shares of stablecoin volume.

• The UAE continues to experience rapid growth in the crypto space, driven by a combination of regulatory innovation, institutional interest, and expanding market activity. Between July 2023 and June 2024, the UAE received over $30 billion in crypto, ranking the country among the top 40 globally in this regard and making it MENA’s third largest crypto economy.

• Türkiye ranks as the largest crypto market in MENA and seventh globally, receiving $136.8 billion in value between July 2023 and June 2024.

“MENA is rapidly emerging as a key player in the crypto economy of the world. The region’s growth, fueled by institutional and enterprise activity, along with a strong appetite for DeFi and stablecoins, points to a likely expansion of MENA’s influence in the crypto space. While CEXs still dominate, the rise of DeFi is also reshaping the landscape with nations like Saudi Arabia and the UAE embracing decentralized platforms. This underscores DeFi’s potential to drive financial inclusion across MENA, especially given the substantial underbanked population in the region at large.”