Jadwa Investment assesses the Saudi Ministry of Finance’s recently released Preliminary Budget Statement for 2025 and mid-year 2024 economic review.

Jadwa Investments October 2024 economic report examines the Ministry of Finance (MoF) has published the preliminary budget statement (PBS) for fiscal year 2025 and the mid-year economic review with detailed estimates for 2024 budget outturns.

At the time of the PBS release, the MoF estimated total expenditures will reach $342.19 billion, and total revenues will reach $315.29 billion, recording a deficit of 2.3% of GDP.

MoF estimates total spending will be 4.8 percent higher year on year, overshooting the budget by 8.3 percent. Spending shifted higher due to three factors: revenue overperformance, the Kingdom’s ample fiscal space and the government’s policy priorities to accelerate economic diversification and improve the quality of public services and infrastructure.

Jadwa’s economic report highlights that:

The finalized budget with full revenue and spending breakdowns will be released in December, when we will publish a correspondingly more detailed report.

- The PBS highlights the government’s policy to support the Kingdom’s economic transformation, while maintaining fiscal space to deal with negative shocks. The government’s fiscal position remains strong.

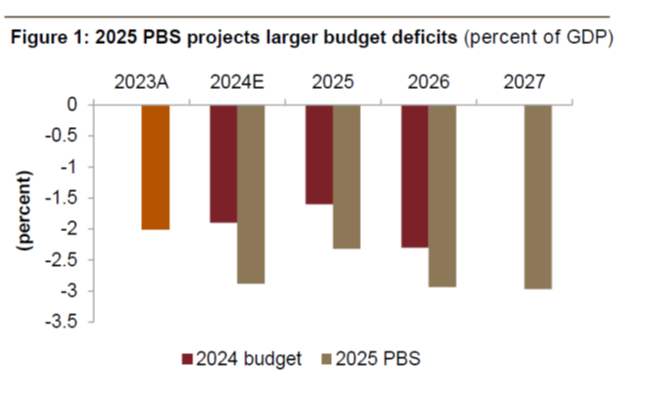

- The PBS outlines larger budget deficits for 2024 and forecast years than the previous set of projections in the 2024 budget statement. PBS deficits average 2.7 percent of GDP in 2025-2027, versus previous projections averaging 1.9 percent of GDP in 2024-2026.

- For 2025 the PBS projects year-on-year declines in both revenue (by 4.3 percent)—most likely due to lower oil revenue forecasts—and spending (by 5.2 percent).

- A decline in budget spending in 2025 could weigh on economic growth, but it is worth noting that:

- overspending relative to budget is likely if oil revenue tracks ahead of budget.

- and the activities of other public-sector entities, notably the Public Investment Fund (PIF) and the National Development Fund (NDF), will support the economy.

- Wider budget deficits for 2024-2027 imply larger increases in government debt. Nonetheless, government debt would remain low, below 35 percent of GDP by 2027.

[Jadwa Investments, Saudi Arabia’s 2025 Preliminary Budget Statement]

According to the report,

“A decline in budget spending in 2025 could weigh on economic growth but overspending relative to budget is likely if oil revenue tracks ahead of budget. When oil prices are high, such as in 2011-2014, spending responds to the higher revenue intake with higher-than budgeted spending. On the other hand, in 2016-2021, during a more moderate oil price climate, spending tracked closer to budgets. This pattern is also seen since 2021, as the government seeks to accelerate its policy priorities, including with higher spending on investment and goods and services needed for that investment.

The PIF and NDF will continue to support the non-oil economy, through capital deployment and credit provision. The PIF’s increased domestic focus could see it further boost its level of capital deployment in the Kingdom in 2025.

For 2026-2027 the PBS pencils in a resumption of revenue and spending growth, with particularly strong gains in 2027. These revenue and spending numbers are subject to revision, but the main takeaway is that the government is willing to plan for budget deficits up to 3 percent of GDP in the coming years to help support growth, economic diversification and the quality of life of citizens.” [Jadwa Investments, Saudi Arabia’s 2025 Preliminary Budget Statement]

Jadwa’s monthly chartbooks and economic reports are tremendous resources for understanding key economic and commercial patterns and trends in Saudi Arabia.

To read more, click here, here and here.