Bond credit rating agency Moody’s Investors Service said Saudi Arabia’s fiscal position remains strong at the A1 rating level, but said that reducing the Kingdom’s high oil dependency is the key credit challenge the country faces.

Moody’s said that while the government has announced ambitious and comprehensive reform plans with its Vision 2030 and National Transformation Plan, implementation of those reforms can be challenging, according to a Reuters brief on the announcement.

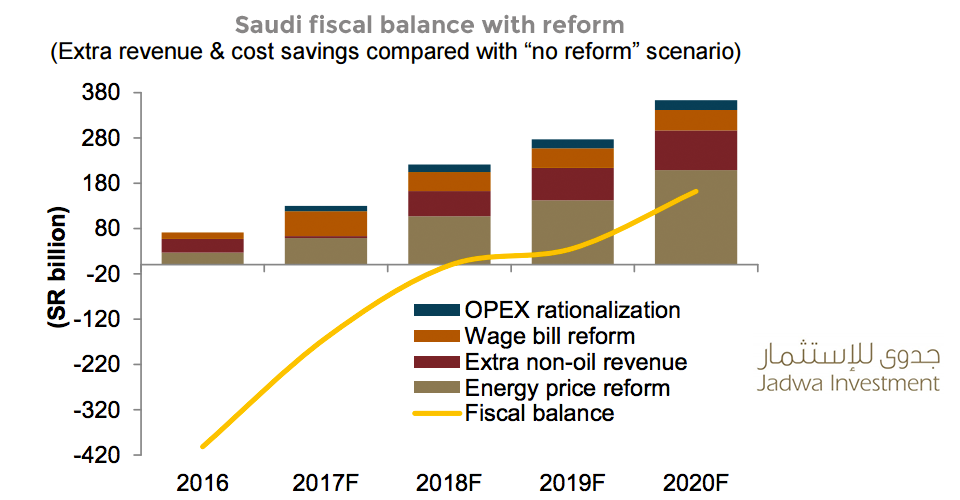

Fiscal balance if Saudi Arabia enacts Vision 2030 reforms.

Overall, the stable outlook given to Saudi Arabia reflects Moody’s view that risks to Saudi Arabia’s credit profile are broadly balanced. The credit rating agency “anticipates a mild real GDP contraction of 0.2% in 2017 due to lower oil production” and forecasts a sizable budget deficit of 10.5% of GDP in 2017, narrowing to 9.2% in 2018.

Over the medium-term, Moody’s forecasts government’s revenue sources will become diversified, with oil and gas revenue declining to 54% by 2020.

The A1 rating given by Moody’s is supported by the Kingdom’s strong fiscal position, Saudi Arabia’s large oil and gas reserves at low production costs, and high levels of external liquidity.