Oil demand growth is set to trend higher this year compared with 2019, a recent report from Jadwa Investment finds, citing OPEC forecasts and other global economic factors.

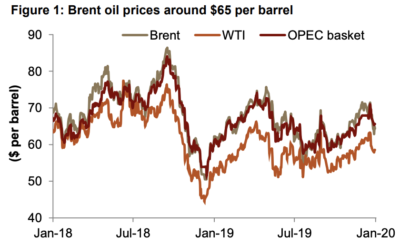

Brent Oil Prices settled at $64.73 on January 21st, 2020.

An expected uptick in global trade, helped along by a recent improvement in US-Chinese trade relations, “should see oil demand growth trend higher this year, at 1.2 percent, or 1.2 million barrels per day (mbpd), versus 930 thousand barrels per day (tbpd) in 2019,” the Jadwa report notes. “On the supply side, OPEC and partners (OPEC+) recently agreed to moderate oil production for the initial three months of 2020. Beyond then, based on OPEC’s projections for demand of its own oil throughout 2020, we would expect an extension in OPEC+ production agreement (perhaps by piecemeal) beyond March 2020.”

Meanwhile, despite sizable yearly rises, the pace of US oil output growth trended downwards in 2019, in-line with a falling number of active oil rigs. In 2020, the Energy Information Administration (EIA) expects the number of rigs to continue declining as producers cut back on capital spending, but this will only translate to significantly slower annual oil output growth in 2021, according to Jadwa.

[Click here to read the full report from Jadwa Investment] [Arabic]