Global oil markets have entered a period of oversupply, putting downward pressure on prices and eliciting calls for the world’s largest producers like Saudi Arabia to act on top of March 2017 OPEC cuts to reduce the glut.

Oil prices fell 3 percent on Friday after data showed U.S. production rose last week just as OPEC exports hit a 2017 high, casting doubt over efforts by producers to curb oversupply, according to Reuters.

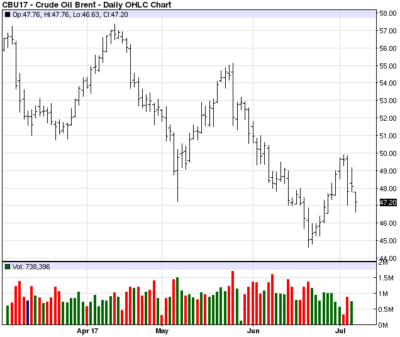

Prices on the Brent Crude index have not recovered to April-level highs, when oil reached $57 a barrel. Oil has struggled to break back over $50 since the start of June, which saw a descent in prices amid concerns the cutbacks by OPEC, Russia and other allies are being partially offset by a rebound in U.S. shale production. Oil closed on Brent today at $47/barrel.

Oil Prices since April 2017.

“Now is the time to maximize the impact of OPEC’s oil production cuts, yet the market is still waiting for the group’s biggest member to show it’s doing “whatever it takes” to eliminate the global oversupply,” writes Grant Smith in Bloomberg. “OPEC’s best chance to make a big dent in the lingering glut in the U.S., and with it reverse oil’s three-year slump, lies in the remaining weeks of peak summertime demand. That’s already become harder because of the resurgence in output from OPEC members exempt from cuts, while there are no signs yet that Saudi Arabia, the group’s de-facto leader, is willing to cut as deeply as it did earlier in the year.”

At issue, as it has been since the shale revolution began, is the unpredictability of U.S. producers. In May of this year, the US exported more than one million barrels of crude oil every day, which is a record.

Saudi Arabia’s state oil company, Aramco, is still on track for the “largest ever IPO” as the Kingdom looks to diversify away from oil. Minister of Energy, Industry, and Natural Resources Khalid Al-Falih said the planned IPO on Saudi and international stock markets was “the most notable feature of the Kingdom’s transformation” as set out in the Vision 2030 plan to reduce its dependence on oil revenue.

It is the significant fall in oil prices on international indices in the past five years that created the moment and impetus for the kingdom’s ambitious Vision 2030 economic plan to de-couple the Arab world’s largest economy from swings in oil prices.