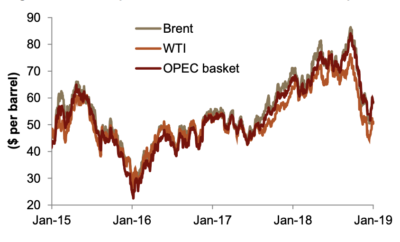

It has been a tumultuous six months for oil prices on international indices. Prices have slightly rebounded early in 2019 after a precipitous fall from over $86 in September on the Brent Index to just over $50 on Christmas Day.

In response, the Saudi-led OPEC+ group agreed in December to cut prices to erode a global glut in supply, but an ongoing trade dispute between China and the United States, Iran sanctions, shale, and broad questions on the global economy will all impact prices in 2019.

Oil prices have rebounded from Christmas Day lows, but uncertainty lies ahead in 2019.

A recently released Jadwa Investment report sheds light on the roller coaster oil market and adjusts its predicted average price of oil in 2019 downward, from $75 to $66 per barrel.

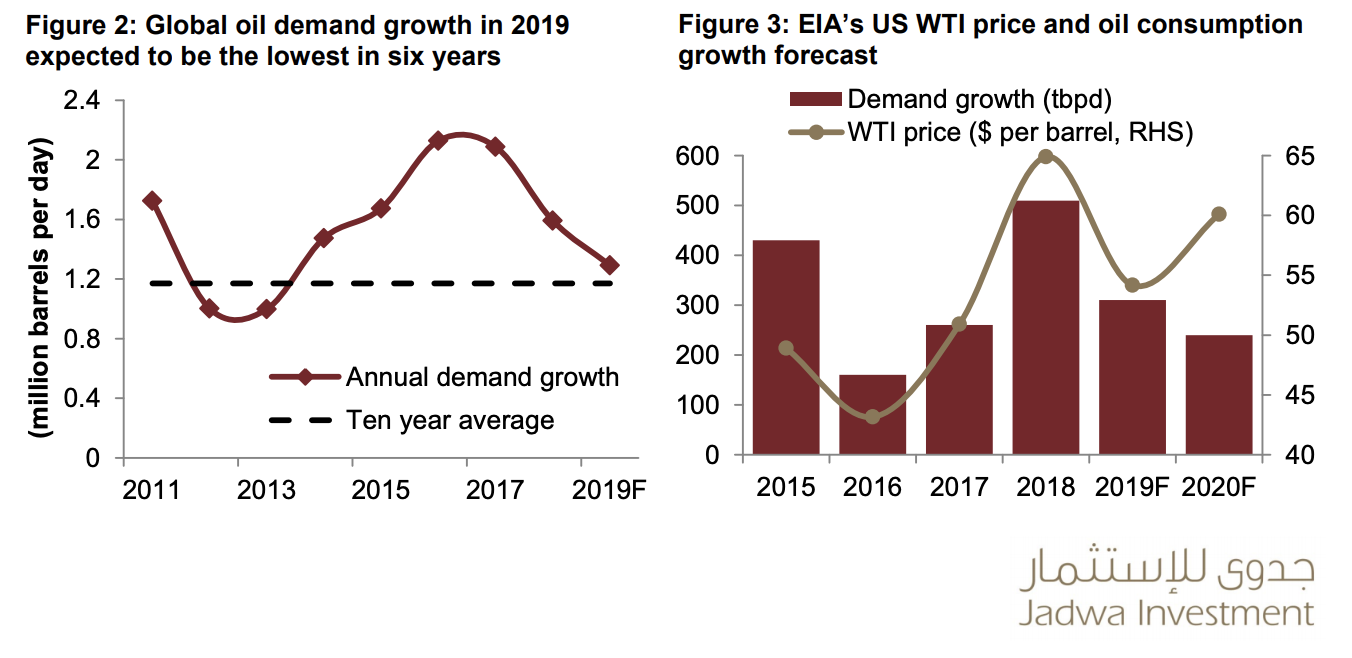

“Lower OPEC output and hopes of some progress over the US-China trade dispute have helped Brent prices recover to around $60 pb recently (Figure 1), although the outlook on oil demand remains subdued. According to latest OPEC forecasts, global oil demand will grow by 1.29 million barrels per day (mbpd) in 2019, the lowest rate of growth since 2013,” Jadwa notes. “That said, there have been encouraging signs in trade talks between the US and China over tariffs recently, and any agreement between the two countries could provide an upside to oil demand, and indeed oil prices.”

The report discusses several of the other external factors weighing on the price of oil – a crucial figure for mega-producer Saudi Arabia as it continues to work to diversify its economy away from dependence on oil revenues.

[Click here for the Jadwa Investment report in English] [Arabic]