Saudi Arabia’s stock exchange, the Tadawul, is in talks to recast its small-cap market, called Nomu, as a hub for the Middle East’s burgeoning startup industry,” people familiar with the matter told Bloomberg.

Tadawul is is in talks with venture capital investors and technology firms in order to position Nomu in such a way that it encourages tech companies to raise money on the exchange’s smaller market instead of doing private funding rounds,

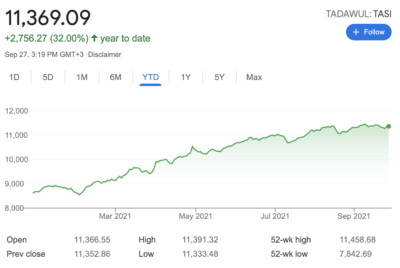

The Tadawul is up 32% YTD.

According to the Bloomberg report, the Tadawul “doesn’t currently offer incentives to list on Nomu, but is telling some startups they could receive regulatory waivers to ease the listing process, the people said. The exchange is expected to continue to encourage firms in other industries to list on Nomu.”

Earlier this month, the Tadawul announced that it is close to announcing plans for a long-awaited initial public offering that could value it at as much as $4 billion.

Riyadh has been a red-hot market for IPOs recently, with new offerings oversubscribed, mostly by local retail and institutional investors.

Currently, Nomu is positioned as a parallel equity market with lighter listing requirements that serves as an alternative platform for companies to go public, and the investment in this market is restricted to Qualified Investors, the Kingdom says. Nomu, which is named after the Arabic word for growth, supports the development and sustainability of small and medium-sized enterprises (SMEs).